Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold has finally broken the downtrend channel on upside and if prices sustain above 51400, it could head higher towards 53000.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

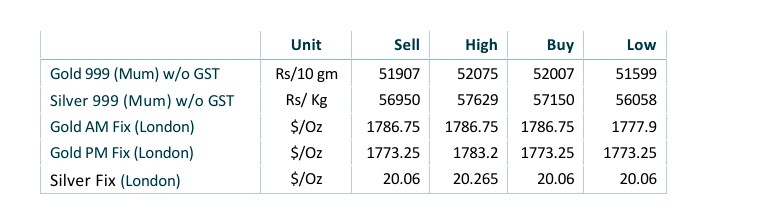

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals eases as robust U.S. jobs data eases recession concerns

- International News – Precious Metal prices extended losses to slide nearly 1% as an encouraging U.S. jobs report eased recession worries and raised hopes the Federal Reserve will stick to its aggressive tightening path.

- Economic Data – U.S. employers hired far more workers than expected in July, with the unemployment rate falling to a pre-pandemic low of 3.5%. A positive employment picture gives the Fed further scope for future rate rises without risking tipping the economy into recession, and gold’s upside gains are likely to be capped at $1,800.

- Domestic News – If there is a pop-up in geo-political issues, then this will help gold, but it won’t be a sustained rally … The next catalyst for gold prices will be (the) U.S. CPI print coming out next week