Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold is consolidating in range of 50000 and 51000, while Silver is in range of 53500 and 56500

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

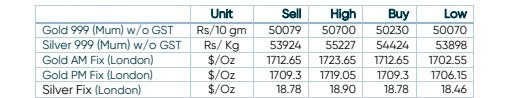

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals edges down as dollar holds ground

- International News – Precious metals slipped into a tight range as a steady dollar countered limited support for bullion from expectations that the U.S. Federal Reserve may not resort to a 100-basis-point interest rate hike next week.

- Demand and Supply – The conflict in Ukraine catalyzed a massive amount of inflows into gold ETFs earlier in the year, but the relevance of that has faded. The hawkish central bank regime is reducing appetite for gold purchases.

- Economic Data– The key events coming up are the ECB, US PMIs before the Fed next week.

- Domestic News– India’s gold imports in June nearly trebled from year-ago levels as prices corrected.