Fundamental News and Triggers

- Precious metals prices are trading near resistance levels ahead of today’s critical NFP report. Hawkish indications from several key Fed officials, together with the minutes of the June FOMC policy meeting, indicate that policymakers were still unsure about lowering interest rates.

- Today’s NFP report is projected to indicate that the US economy gained 190,000 jobs in June, compared to 272,000 the prior month. The critical data will play an important role in shaping market expectations about the Fed’s future policy actions, which will boost USD demand and offer a new directional push to Gold and Silver.

- The US dollar is under pressure due to expectations that the Federal Reserve’s rate-cutting cycle will begin in September.

Technical Triggers

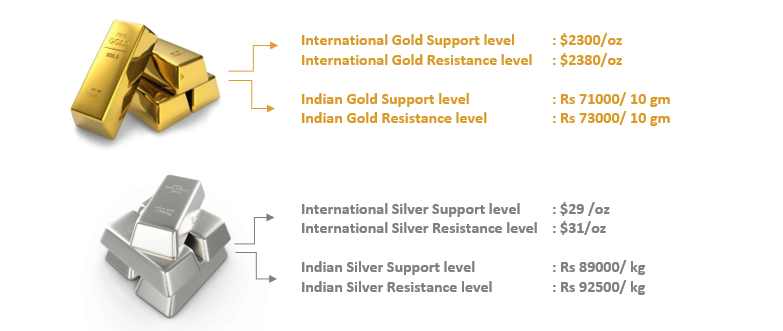

- Gold is trading in a range with a descending triangle with lower highs and higher lows. The triangle is becoming narrower and narrower every week, so a breakout is imminent. A sustainable close above $2380 (Rs 72800) and a sustainable close below $2300 (Rs 71000) will confirm a downside breakout.

- Silver is trading in a range with a descending trend channel with lower highs and lower lows. A sustainable close above $31(Rs 92500) will give a breakout towards the upside, while a sustainable close below $29 (Rs 89000) will give a breakout towards the downside.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.