Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) -Rangebound–– Gold is again trading in same range 50200 to 51200 and silver range is 59000 to 62500

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

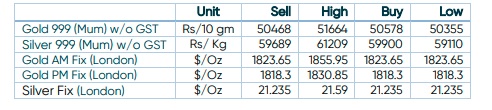

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals get ready for another rate hike

- International News – Gold and Silver prices are moving back and forth, gathering strength for the next move. Or, waiting for the next trigger from FED meeting

- Demand and Supply – – – Most analysts believe that a recession is coming sooner rather than later, gold’s long-term outlook doesn’t look to bad. Looking at the Fed

funds futures curve, markets very much remain of the opinion that after some aggressive near-term hiking from the Fed coupled with a recession over the next 12

or so months, US inflation should come eventually come under control, giving the Fed the space to then cut interest rates in the longer-term. - Economic Data – – Investors weigh the probabilities of three Fed scenarios: A 50bps, 75bps or even a 100bps hike

- Domestic News– India imported 101 tonnes of gold in May, compared to 13 tonnes a year earlier due to Akshaya Tritiya and Wedding Season