Fundamental Q News and Triggers

• The increase in Treasury yields and its effects on the currency market have been the focus of September. The market anticipated a decline in the economic figures, but that hasn’t happened.

• Sales of new single-family homes in the United States decreased more than anticipated in August, according to data released on Tuesday, although annual home price rise increased for the second consecutive month in July.

• In September, consumer confidence in the United States decreased for a second consecutive month due to concerns about rising prices and the political climate.

Technical Triggers

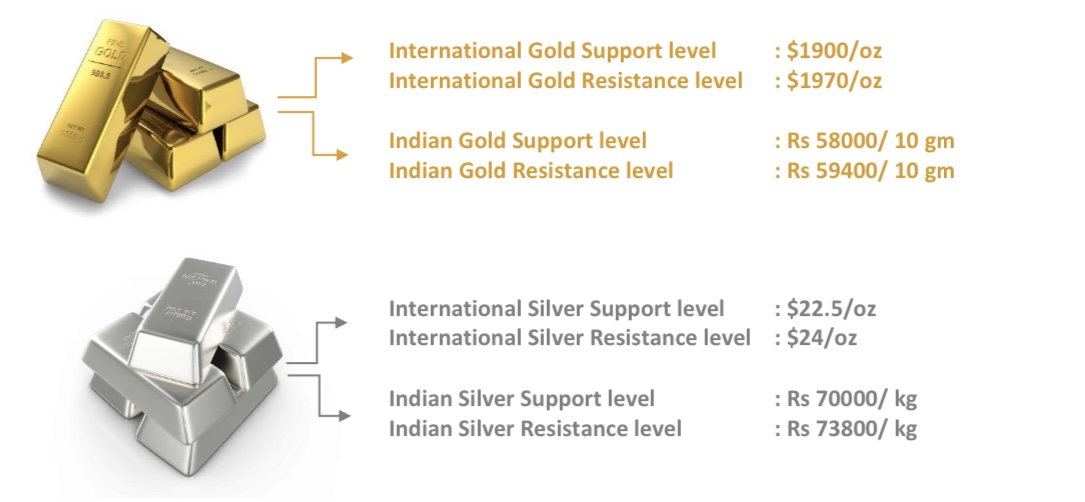

• Gold touched important support of $1915 (Rs 58300) on continuous Dollar strength. As the prices have fallen too much, we are likely to see some support around $1900 (Rs 58000).

• Silver prices have been continuously taking support at the uptrendline, which now suggests that the next support is at $22.5 (Rs 70000). This level should give support to prices for the uptrend to continue.

Support and Resistance

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.