-

Gold and silver – Kya Lagta Hai

Short-term view (up to 1 week) – Weakness– Gold has broken support at downtrend channel again, while Silver is continuously trading below its downtrend line from last 5 months

Long-term view (3-4months) – positive – – – Any dips towards 50000 and 52000 should be used as buying opportunities for the target of 55000 and 60000 for Gold and Silver respectively by year end.

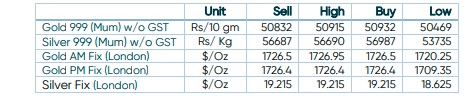

Spot Prices

Spot gold daily price chart

Spot silver daily price chart

Important news and triggers

- International news – Gold jumped 1% and silver rallied over 6% on Monday bolstered by a weaker dollar, while investors awaited key inflation data for cues on the pace of interest rate hikes by the U.S. central bank.

- Demand and Supply – – The Fed is largely expected to deliver a 75-basis point rate increase later this month. The U.S. central bank has raised its benchmark overnight interest rate by 225 basis points in total since March to fight soaring inflation.

- Economic data – – – European Central Bank officials have signaled further rate hikes to rein in inflation, which has supported the euro and pressured the U.S. dollar and is in part responsible for some strength in the gold market,

- Indian Demand – India’s gold imports in August halved from a year earlier to 61 tonnes as volatile local prices and a weak rupee prompted consumers to postpone purchases.

Disclaimer

-

-

This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices

-