Fundamental Q News and Triggers

• Gold is seeing downward pressure as markets reevaluate their expectations of the Federal Reserve’s willingness to lower interest rates.

• The fact that the price of crude oil has fallen to a 3.5-month low and that the yellow metal’s near-term technical stance has gotten worse this week has put the sellers in charge and prompted some chart-based selling by speculators. Due to alleged bargain hunting, silver prices are stable.

• The end of next week marks another deadline for the U.S. government to shut down, which would help prices. By the deadline of November 17th, the Republican-controlled U.S.House of Representatives had failed to agree on a plan to continue funding government agencies.

Technical Triggers

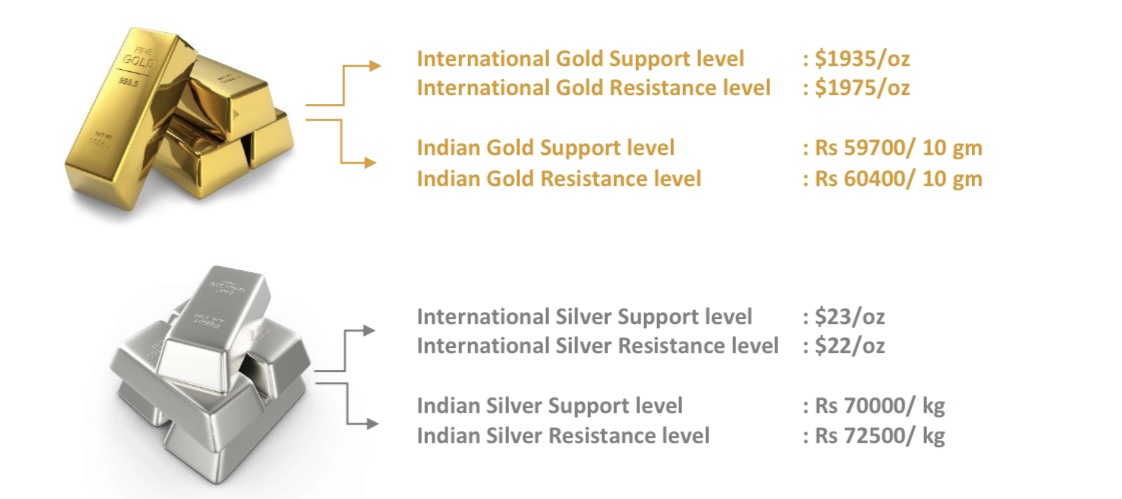

• As suggested yesterday, if gold prices break 60200, and can touch 59700, the prices are in the same course in the short term. The long-term view is still bullish, buy on dips.

• As suggested yesterday, if Silver prices break 70900, and can touch 70000, the prices are in the same course in the short term. The long-term view is still bullish, buy on dips.

Support and Resistance

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.