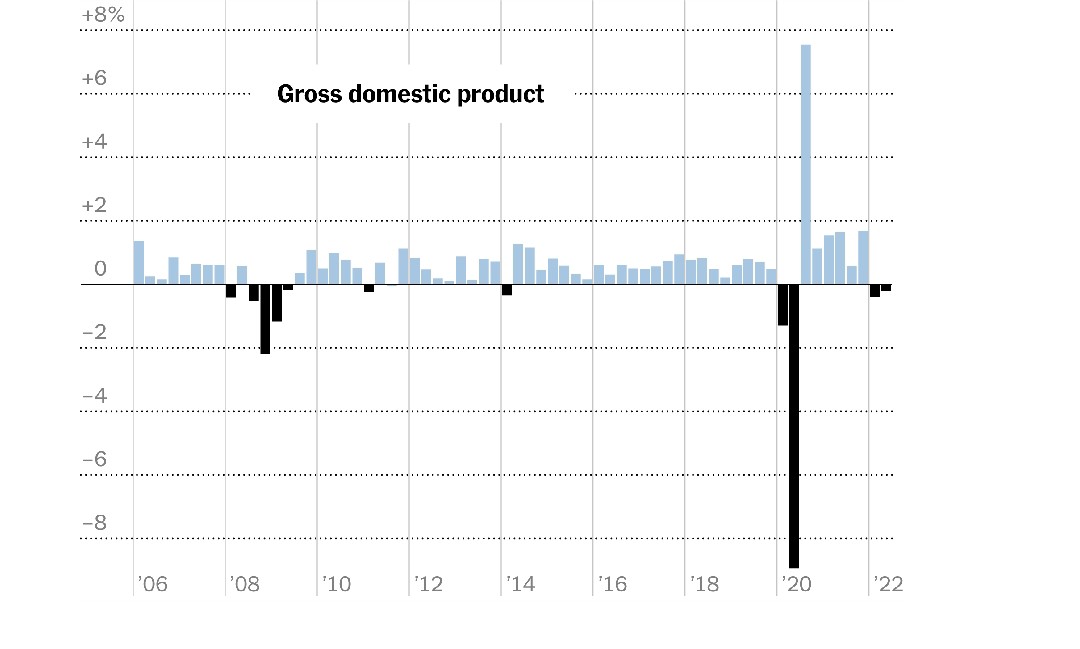

Data released this week revealed that the US economy has entered a “technical recession,” a warning flag for the rest of the globe. The official definition of a recession is two consecutive quarters of decreasing GDP. According to Commerce Department estimates, the United States’ GDP decreased 0.9 percent on an annualised basis in the second quarter. This comes on the heels of first-quarter GDP figures showing that the US economy shrunk 1.6 percent in the first three months of 2022.

The new data highlight the magnitude of the damage that unprecedented high inflation is wreaking on the world’s largest economy, while also diminishing consumers’ purchasing power. With inflation rising at its strongest rate in more than four decades, further rate hikes are predicted well into the second half of 2022, although the timing of those increases is highly discussed.

However, it goes without saying that inflation is the Fed’s top aim, and they are willing to go to any length to achieve it, even if it means a recession. On Wednesday, the Federal Reserve hiked interest rates by a “super-sized” 75 basis points for the second month in a row, doubling down on its hardline approach to taming swiftly increasing inflation despite early indications that the US economy is losing speed.

Silver prices have risen for four days in a row, breaking through the $20 mark for the first time since July 5, and are on track to close the week up nearly 9%. Following a drop below $1760 earlier this week, gold has also gained bullish momentum. The benchmark 10-year US Treasury bond yield is down more than 1%, putting gold on a strong footing heading into the weekend. However, the next significant goal looms at the critical $1800 per ounce troy level.

The S&P Global and ISM Manufacturing, Services, and Composite PMIs will be released next week on the US economic calendar. Along with the Fed’s speech, the US Nonfarm Payrolls report would dominate news headlines.