Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) -Rangebound–– Gold is again trading in same range 50200 to 51200 and silver range is 59000 to 62500

Long-term View (3-4months) -Positive –Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

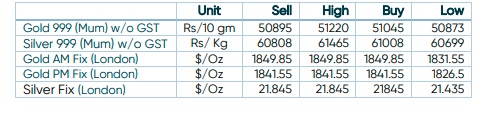

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals continue to rally on follow through buying

- International News – – Precious Metals remains sidelined despite the bounce off intraday low, flashed biggest weekly fall in a month at the latest. Fears of economic slowdown, higher Fed rates underpin US dollar’s safe-haven demand.

- Demand and Supply – – -Besides, gold continues to remain in demand for its safe-haven status as there is no end in sight to the war in Ukraine. The global economy is showing signs of a slowdown owing to the war and the Western sanctions imposed in response to it, which will continue to draw investors towards the precious metal.

- Economic Data – – – Fed Chair Powell’s testimony will be crucial after recent inflation fears triggered 75 bp rate hike.

- Domestic News– – – Discounts on physical gold in India narrowed this week, helped by some fresh buying from jewellers, while COVID-19 restrictions kept activity tepid in top consumer China.