Fundamental News and Triggers

• After the U.S. manufacturing sector shrank for the eighth consecutive month in June, the gold market rebounded in short-term. Last month, the manufacturing ISM (Institute for Supply Management) index was 46%. The index was predicted by market consensus be at 47.2%.

• Interest rate traders currently expect the first cut in rates to occur in May 2024, peaking in late 2023. This could work against gold over the next 10 months as the dollar is expected to stay strong and non-yielding assets become less appealing.

Technical Triggers

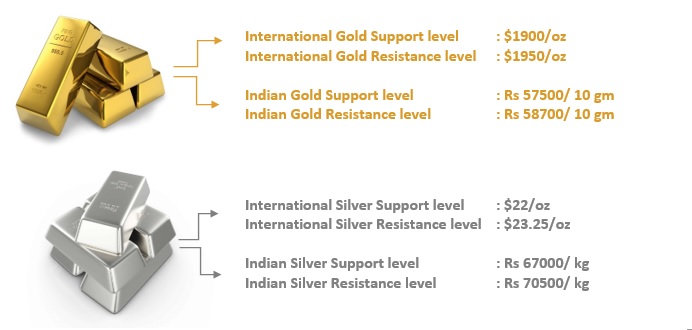

• Gold prices have rebounded from strong psychological support of $1900 (~ Rs 57500), next resistance is $1950 (~ Rs 58700).

• Silver prices have very important support around $22(~ Rs 67000), which is a 50% Fibonacci retracement level of rally from $18 to $26. Prices have rebounded from that level heading towards next resistance of $23.25 (~ Rs 70500)

Support and Resistance

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.