Precious Metal ends the week in advance since the middle of November, following several central bank announcements on monetary policy. The Bank of England unexpectedly raised interest rates on Thursday for the first time in three years, setting aside concerns over the coronavirus to tackle the highest inflation in more than a decade. A day earlier, U.S. Federal Reserve officials decided to double the pace of tapering, while projecting a series of rate increases in coming years, starting with three hikes in 2022. In a more nuanced move, the European Central Bank temporarily boosted monthly bond buying for half a year to smooth the exit from pandemic stimulus, while the Bank of Japan took a cautious stance on winding down support Friday.

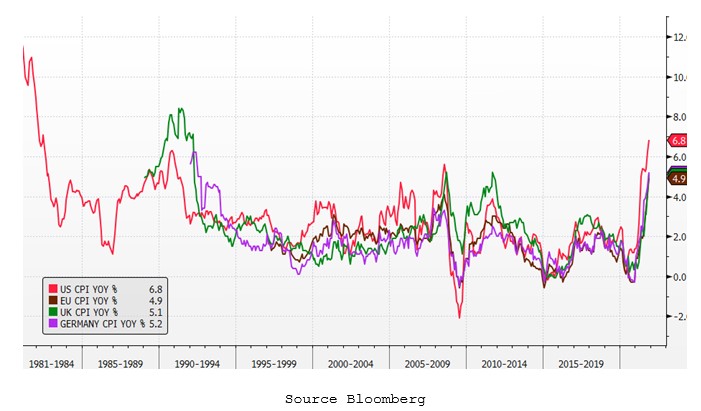

In the United States, inflation is currently at a 39-year high of 6.8%, in Germany at more than 5%, the highest level in 29 years, and in the Eurozone at 4.9%, the highest since the start of the monetary union in 1999.

Inflation (CPI) of developed economies

The Fed, European Central Bank, Bank of England and Bank of Japan are all wrestling with how to cool inflation this week, with many developing nation policy makers already raising interest rates to support falling currencies. The Fed said Wednesday it will double the pace of its bond tapering to begin raising rates next year after U.S. inflation grew the fastest in nearly 40 years.

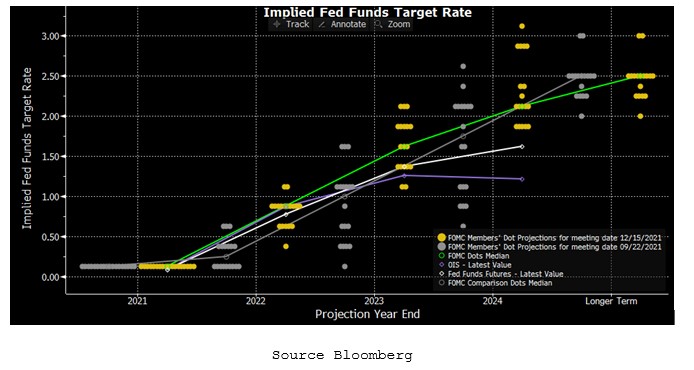

FED Future DOT Plot

Above chart displays the most recent quarterly survey, with the date indicated in the amber box at upper left. Individual FOMC members’ forecasts are shown as yellow dots. The median forecast of Fed officials is shown by the green line. The white line shows rate expectations as indicated by Fed funds futures, while the purple shows expectations reflected in overnight interest rate swaps.

FED projection is for 0.75% by the end of 2022, 1.5% by the end of 2023 and 2% by the end of 2024. The market signals rates will be lower, with Fed funds futures implying 1.5% at the end of 2024. The latest dot plot shows a tighter consensus for 2023 and 2024 than in September. For the longer term, the median forecast remains at 2.5%.

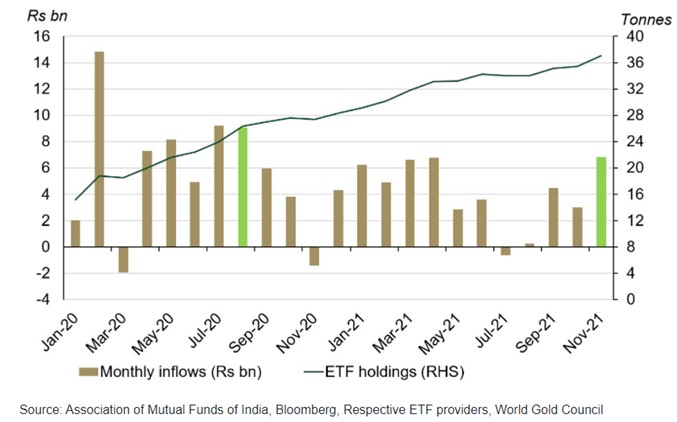

Meanwhile, Indian gold ETFs continued to attract inflows, driven by seasonal demand surrounding the Diwali festival and concerns around elevated equities, which led to a correction in the local stock market later in the month. Net November inflows of 1.6tonnes took total Indian gold ETF holdings to 37.3 tonnes.

Indian Gold ETFs Flows

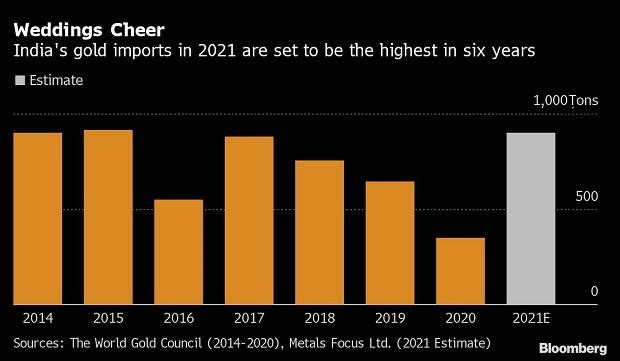

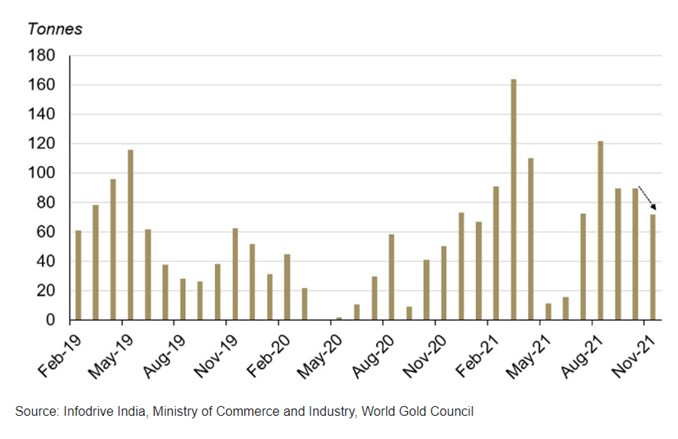

In the meantime, wedding rush sets record, sends India’s gold imports surging to 6-year high in 2021. The bumper festival season may help push India’s gold imports to as much as 900 tons in 2021, the highest in six years. There were a lot of weddings that were postponed from the previous year and now again the pandemic scare is picking up. About 2.5 million ceremonies are estimated to have taken place since mid-November, around a quarter of this year’s expected annual total.

But Indian official gold imports declined to 72 tonnes in November – 19% lower m-o-m but 43% higher y-o-y. A total of seven banks, nominated agencies and exporters imported 41t of bullion, and 21 refineries imported an equivalent 31.1t of fine gold content in the form of gold doré. Gold price volatility, healthy bullion inventory levels and concerns over new Omicron variant may dissuade trade from increasing imports further.

Indian Gold Imports month-wise

Over the course of the last six weeks, precious metal prices have charged to a five-month high, and fundamentally, gold remains strong after higher inflation reported by the US and by the UK during the week. Gold is used as a hedge for inflation, so the bias remains bullish.