Fundamental News and Triggers

- After reaching an all-time high of $2488 (74730), gold prices fell as speculators booked profits and investors were unable to hold onto their gains. This boosted flows to the US dollar coupled with former US President Donald Trump’s threats to impose at least 60% tariffs on Chinese goods.

- In the meanwhile, there are questions about the US’s willingness to protect Taiwan in the case of a Chinese invasion after former President Donald Trump stated that Taiwan should foot the bill for US defence. This adds to the geopolitical unrest brought on by the Middle East crises and the extended war between Russia and Ukraine, which should help Gold.

- However, the FedWatch Tool from the CME Group shows that markets are pricing in a 100% likelihood of a rate decrease in September and an extra two cuts by yearend.

Technical Triggers

- Gold prices have reversed from $2488 (Rs 74730) and have formed an “Inverted Hammer” candlestick pattern on weekly charts. Important support on the uptrend line from February lies around $2350. Until prices are sustained above this level, we could see the bull run continuing

- Silver touched $32 (Rs 94500) and then retraced back below $30 (Rs 91000). Next support lies around $29.40 (Rs 90000).

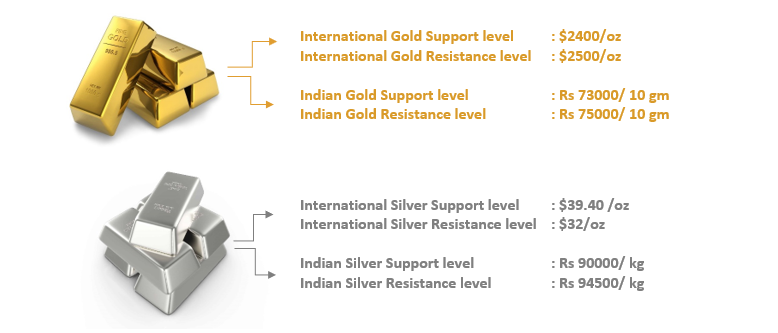

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.