Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold is able to sustain above downtrend channel after 4 months while silver is on the verge of crossing the downtrend line

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

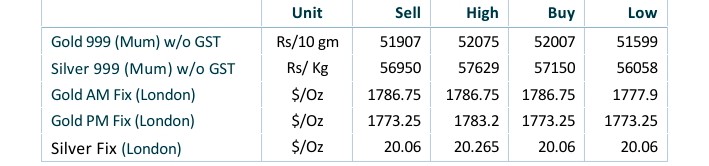

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals still digesting bumper NFP report

- International News – Precious metal prices edged lower on Monday after solid U.S. jobs report last week boosted the prospect of aggressive interest rate hikes by the U.S. Federal Reserve, lifting the dollar and Treasury yields.

- Economic Data – Traders currently see a 73.5% probability the Fed continues the pace of 75-basis-point rate hikes for its next policy decision on Sept. 21 to tame soaring inflation after U.S. job growth unexpectedly accelerated in July.

- Domestic News – If there is a pop-up in geo-political issues, then this will help gold, but it won’t be a sustained rally … The next catalyst for gold prices will be (the) U.S. CPI print coming out this week