Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rebound – – Silver prices have given a breakout above its downtrend channel after six months

Long-term View (3-4months) – Positive – – – Any dips towards 51000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively in long-term.

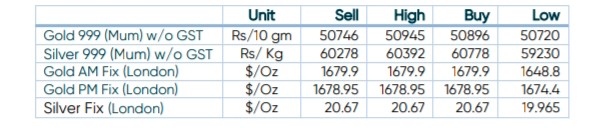

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – – The U.S. CPI report is due on Thursday, as per the preliminary estimates, the headline CPI is expected to lower at 8.0% vs. the prior release of 8.2%. Traders are now expecting 65% odds of a 50-basis-point rate hike at the Fed’s December meeting. Focus is also on the U.S. midterm elections, which will determine control of Congress and could spur moves all over the market.

- Demand – – – Indian silver consumption is forecast to surge by around 80% to a record this year, as traders draw down inventories in warehouses from London to Hong Kong after two Covid-riddled years. This year, silver sales are back on track. Local purchases may surpass 8,000 tons in 2022 from about 4,500 tons last year.

Disclaimer