Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold and Silver prices have rebounded, as it was oversold.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

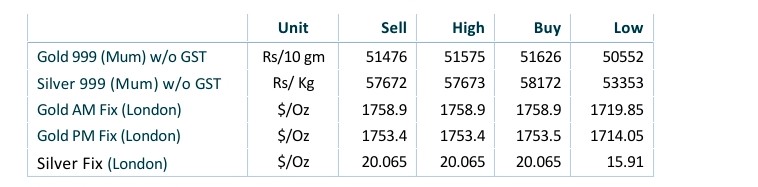

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Precious Metals turns bullish as probability of hard landing increases

- International News – Gold rises more than 3% weekly to trade around $1780 per troy ounce and Silver up by 9% to trade above $20, supported by a weaker U.S. dollar, but mostly by lower bond rates following slower GDP numbers and the Fed’s latest decision and guidance.

- Demand & Supply – Indian Gold demand in the June-ended quarter was up 43 per cent to 171 tonnes against 120 tonnes reported in the same period last year on the back of buying for wedding and festival season.

- Economic Data – The July FOMC meeting gave way to a sharp pullback in Treasury yields, with the 2-year yield dropping to its lowest level in nearly a month (2.84%) as comments made by Chair Powell were taken as a signal that peak Fed hawkishness has passed.

- Domestic News – The India International Bullion Exchange which has enrolled over 60 qualified jewellers to trade on the exchange and set up infrastructure to store physical gold and silver was launched last weekend.