Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Gold is consolidating in range of 50000 and 51000, while Silver is consolidating in range of 55000 and 58000

Long-term View (3-4months) – Positive – Any dips towards 50000 and 56000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively by year end.

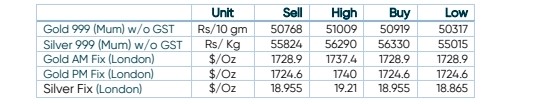

SPOT PRICES

SPOT Gold Hourly Price Chart

SPOT Silver Hourly Price Chart

Important News and Triggers

Probability of 100 bps interest rate rises to 82% after CPI data

- International News – After June’s super-hot consumer price index, market expectations began to climb and they went even higher after the Bank of Canada raised its rate by 1%. Traders are betting the Federal Reserve could raise its target fed funds rate by 1 percentage point at its July 26-27 meeting.

- Demand and Supply – After June’s super-hot consumer price index, market expectations began to climb and they went even higher after the Bank of Canada raised its rate by 1%. Traders are betting the Federal Reserve could raise its target fed funds rate by 1 percentage point at its July 26-27 meeting.

- Economic Data– The dollar retreated from two-decade highs after the Consumer Price Index surged 9.1% during the year to June.

- Domestic News– India’s gold imports in June nearly trebled from year-ago levels as prices corrected.