By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

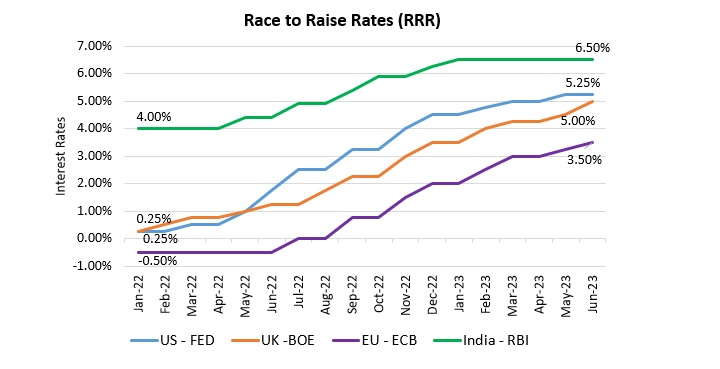

Gold and Silver prices plummeted by more than 2% and 7%, respectively, last week as the central bank turned hawkish in its monetary stance to combat elevated inflation. US FED paused the interest rate hike after 10 straight rounds of tightening but hinted at more two rate hikes in the coming months. The Bank of England raised interest rates by 0.5%, which was twice what was expected, claiming that it had to do so in response to “significant” signs that British inflation would not decline as quickly as expected. The interest rate in the United Kingdom has increased to 5%, which is the highest level since 2008.

The U.K. central bank has increased rates 13 times in a row, trailing only the Federal Reserve, which has increased rates in the United States to a peak of 5%. Not only US and UK, but central banks around the world are also in a race to raise interest rates to tame inflation. The central bank of various countries like Canada, Australia, Norway, Switzerland, India, etc has turned hawkish and raised interest rates several times since 2022. While Norway’s central bank increased its key policy rate to a 15-year high, the Swiss National Bank increased its policy rate and indicated that additional tightening was likely.

Moreover, the leaders of the major central banks are expected to pledge to combat inflation with rapid rate increases when they meet next week at the World Economic Forum in Portugal.

Amidst all this, Gold and Silver have lost their sheen as safe-heaven assets, because rising interest rates are bad news for gold because they increase the opportunity cost of holding bullion. Gold and Silver prices are expected to remain weak in the short term as we will see more rate hikes in the coming two months.

But there is some good news for Gold and Silver, first, continuous rate hikes will hamper the growth of the economies in the medium term. We will gradually see the GDP growth rate fall for US, UK, EU and other countries by the end of 2023. Some economies might also fall into recession by the end of 2023 or early 2024. Secondly, there is strong investment demand for Gold by Central banks around the world as they move towards De-dollarization. Therefore, these two factors – Recession Concerns and De-dollarization will keep bullion prices supported from a steep decline.

For a recession-proof portfolio, one should allocate at least 20% of the portfolio to Gold and Silver. And the best way to stay invested in Gold and Silver in a new financial year is to invest 50% in lumpsum at current prices and divide the rest 50% through the Systematic Investment Plan (SIP) every month. Augmont- Gold for All offers both of these investment alternatives through its products like Augmont Digi Gold/Digi Silver and Augmont Gold SIP/ Silver SIP.