gold and silver – kya lagta hai

short-term view (up to 1 week) – Weakness– Gold has broken support at downtrend channel again, while Silver is continuously trading below its downtrend line from last 5 months

long-term view (3-4months) – positive – – Any dips towards 50000 and 52000 should be used as buying opportunities for the target of 55000 and 60000 for Gold and Silver respectively by year end.

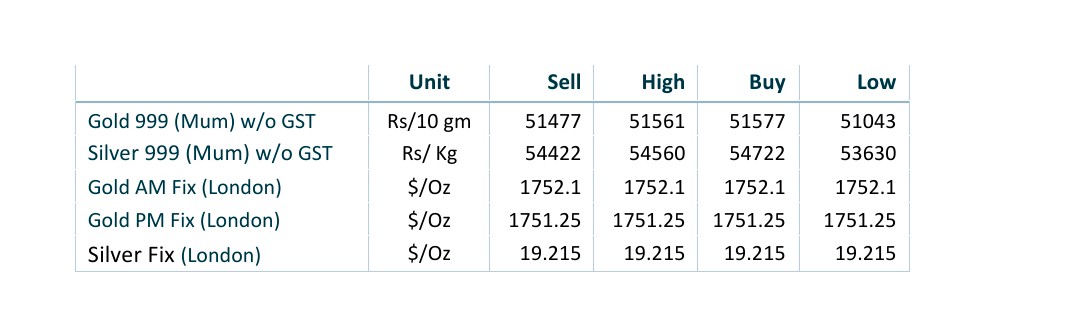

spot prices

spot gold daily price chart

spot silver daily price chart

Important news and triggers

Rate hike rush pulls down precious metals

- International news – Precious Metals have been on trading bearish, enroute to its longest run of monthly losses since 2018, pressured by aggressive rate hikes by major central banks across the world.

- Demand and Supply – – As long as gold is priced in the U.S. dollar, it’s critical to keep the latter in mind. And last week, something epic happened in the forex market. Namely, the EUR/USD closed the week below the all-important 1 level. For the first time in almost two decades!

- Economic data – – It’s getting much more clearer that central banks are going to be aggressive with tightening due to unprecedented inflationary pressure, which is not good for gold.