By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold and Silver prices remained under heavy selling pressure amid the continuation of the Trump trade. Last week, gold prices fell nearly 5%, marking the steepest weekly decline in almost three years. From its peak of $2801 on 31st Oct, the metal has now lost over $250 or approximately 9%, making this the most sustained downturn since the start of the month. Silver has lost $5 almost 15%, falling from $35 to $30.

Bitcoin has reached the $94000 milestone since Donald Trump restored faith to the cryptocurrency industry. If he were to return to the White House, traders hoped he would favor cryptocurrencies.

Furthermore, the Federal Reserve may be forced to halt its easing cycle if Trump’s intentions to increase import taxes drive inflation. Furthermore, US inflation data issued on Wednesday indicated a slower rate of price reductions. Both CPI and PPI inflation are formally back on the rise for the first time since September 2022. This helps to push money away from the non-yielding price of gold and maintains support for high US Treasury bond yields.

The economic calendar for next week is favorable once more, with the housing sector being the main focus. MBA mortgage applications are due on Wednesday, October existing home sales are due on Thursday, and Building permits and U.S. housing starts are due on Tuesday. As the markets try to predict the pace and extent of future rate reduction, there will also be a number of central bank speakers to keep an eye on.

In the most recent incident over the weekend, US President Joe Biden gave Ukraine permission to strike inside Russia using US Army Tactical Missile Systems. Following Moscow’s deployment of North Korean foot troops to bolster its military, the decision was made to permit the use of long-range US weaponry inside Russia. In light of the ongoing dispute between Israel and Iran, markets are still cautious about a possible escalation of tensions between Russia and Ukraine, which is causing safe-haven flows into the shiny metal.

It seems now renewed geopolitical tensions will overcast the Trumponomics and precious metals prices will rebound again this week.

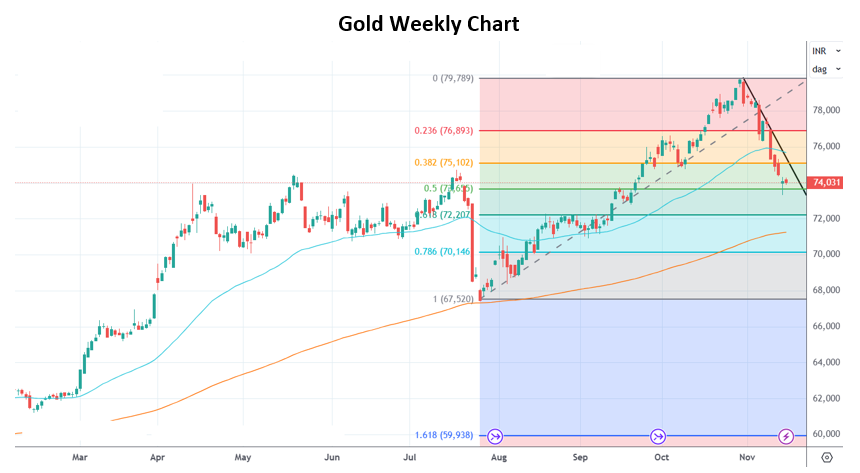

As discussed in the last Weekly Blog “Gold and Silver dumped, as US Trumped”, gold prices continued their southward journey and indeed achieved that target of Rs 74000 last week. I think, gold prices have made short-term bottom now and are expected to rebound again towards Rs 75000 and Rs 77000.

Silver Daily Chart

As discussed in the last Weekly Blog “Gold and Silver dumped, as US Trumped”, Silver prices continued their southward journey and indeed achieved that target of Rs 88000 last week. I think Silver prices have made a short-term bottom now and are expected to rebound again towards Rs 92000 and Rs 95000.

For those who are waiting to buy gold and silver for investment, these dips in November should be used as an opportunity as prices will continue their uptrend in 2025.

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.