Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Rangebound– Having tested the 100-Simple Moving Average, now at $1738 on the four-hour chart last Friday, gold price has entered a phase of upside consolidation.

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

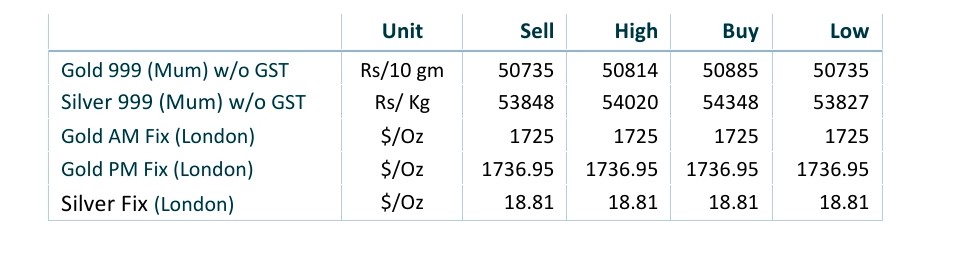

SPOT PRICES

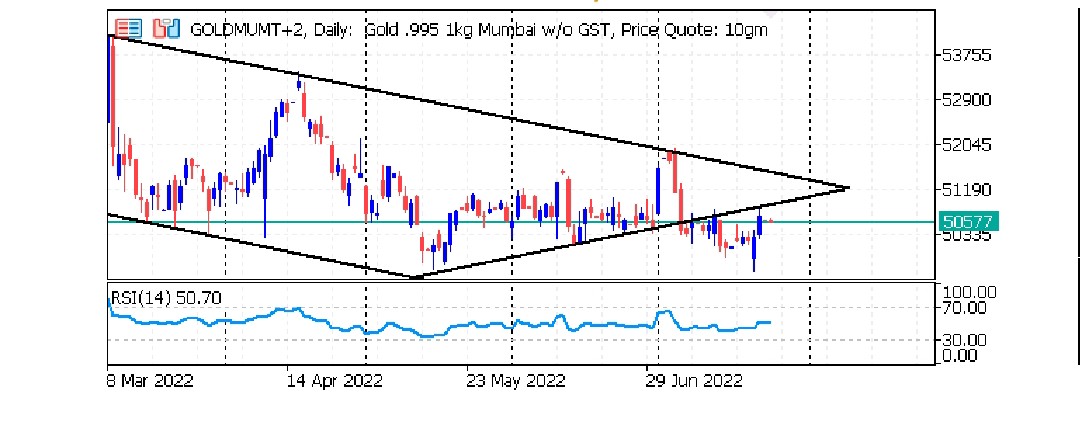

SPOT Gold Daily Price Chart

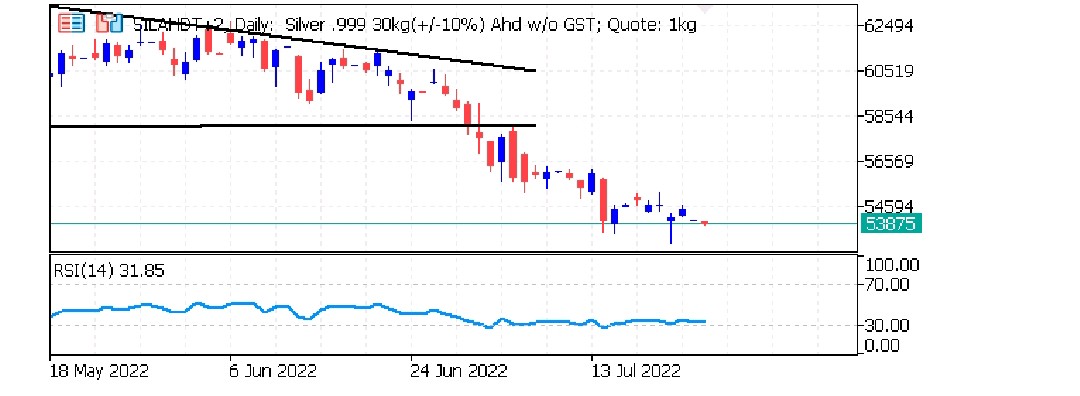

SPOT Silver Daily Price Chart

Important News and Triggers

Rising Fed rate hike decision and Q2 GDP in focus

- International News – Gold price is reversing an early dip but remains cautious at the start of the critical Fed week. The rebound in the US dollar from over two-week lows capped the bullion’s ongoing recovery momentum. The greenback climbed on the back of renewed risk-off flows.

- Economic Data– Investors remain worried over a potential negative US GDP print in the second quarter, which would tip the world’s largest economy into a technical recession.

- Domestic News– Gold jewellery manufacturing units in Mumbai, Ahmedabad, Coimbatore, Kolkata and Rajkot have cut work time to 6-7 hours from 8-10 hours earlier as demand had fallen by more than 60% after the government hiked import duty to 12.5% from 7.5% last month.