Gold and Silver – Kya Lagta Hai

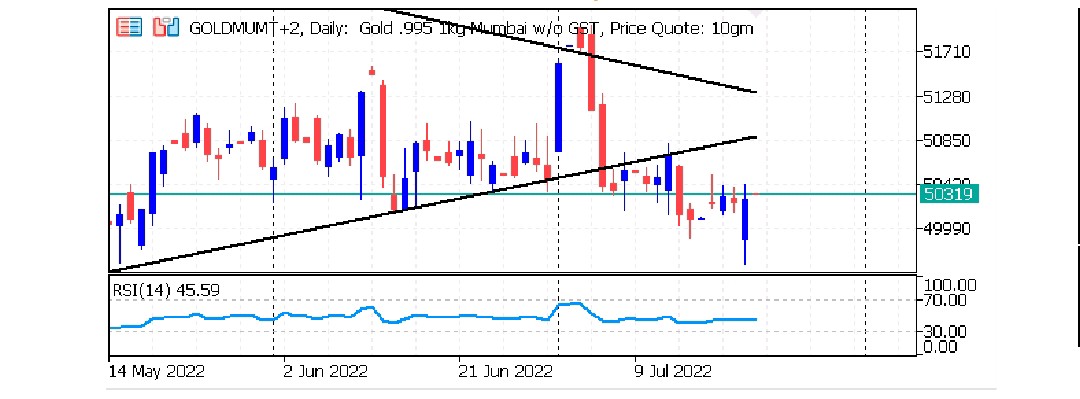

Short-term View (up to 1 week) – Rangebound– Gold is consolidating in range of 50000 and 51000, while Silver is in range of 53500 and 56500

Long-term View (3-4months) – Positive – Any dips towards 50000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively by year end.

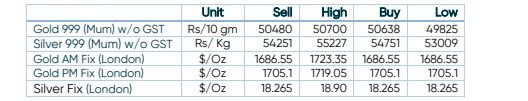

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Rising Interest rates acting headwind for precious metals

- International News – The prospects for further interest rate hikes by major central banks to curb inflation might continue to act as a headwind for precious metals

- Demand and Supply – The conflict in Ukraine catalyzed a massive amount of inflows into gold ETFs earlier in the year, but the relevance of that has faded. The hawkish central bank regime is reducing appetite for gold purchases.

- Economic Data– The ECB followed the global tightening trend and raised its official rates for the first time since 2011 on Thursday. The Federal Reserve is also expected to raise rates by another 75 bps at its upcoming policy meeting on July 26-27. Moreover, the Reserve Bank of Australia had signalled earlier this week the need for higher interest rates to tame rising inflation

- Domestic News– India’s gold imports in June nearly trebled from year-ago levels as prices corrected.