Gold and Silver – Kya Lagta Hai

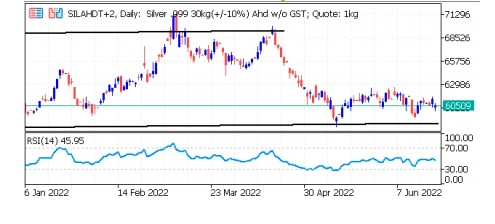

Short-term View (up to 1 week) -Rangebound–– – Gold is again trading in same range 50200 to 51200 and silver range is 59000 to 62500

Long-term View (3-4months) -Positive – Any dips towards 50000 and 60000 should be used as buying opportunities for the target of 55000 and 70000 for Gold and Silver respectively

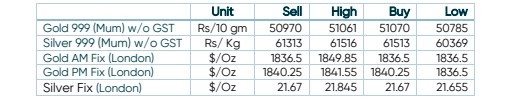

SPOT PRICES

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

Risk-off impulse, sliding US bond yields, modest USD pullback supports precious metals

- International News – – Geopolitical uncertainty and elevated worries of policy mistakes are likely to continue to be supportive, and any escalation on either worry could see gold breaking above the $1,875-$1,895 resistance, with a target near $1,960, especially if USD strength starts to slow.

- Demand and Supply – – – – Investment demand remains weak. The premium for physical gold turned positive in China and India, but demand in China has been weighed down by lackluster retail jewellery sales. Indian gold imports rebounded in May driven by the traditional wedding season. That said, off-season months could see physical demand weaken.

- Economic Data – – – The continued weighing on investors’ sentiment and triggered a fresh wave of the global risk-aversion trade, which, in turn, offered some support to the safe-haven gold.

- Domestic News – – Discounts on physical gold in India narrowed this week to $6, helped by some fresh buying from jewelers,