Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Positive – Domestic Gold and Silver

prices seems to have bottom out due to depreciating rupee.

Long-term View (3-4months) – Positive –Any dips towards 49000 and

52000 should be used as buying opportunities for the target of 52000 and

60000 for Gold and Silver respectively in long-term

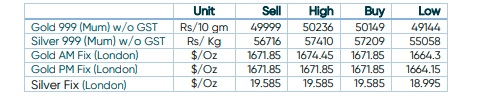

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – Gold prices pared losses on Thursday as the dollar pulled back from a two-decade high, although elevated U.S. bond yields and hawkish

remarks on future rate hikes from the Federal Reserve pressured bullion. - Economic Data – The US Federal Reserve raised its target interest rate by three-quarters of a percentage point to a range of 3.00%-3.25% on Wednesday and signaled more large increases to come in new projections showing its policy rate rising to 4.40% by the end of this year before topping out at 4.60% in 2023 to battle continued strong inflation.

- Currency Markets – US Dollar Index has printed a fresh two-decade high above 111.7 after FED raised 75bps Interest rate. This has led to depreciation in USDINR, which is trading at lifetime low around 81. Depreciating rupee has supported domestic bullion prices even though, international gold prices are trading weak

Disclaimer