On 28 Sep 2021, the Securities and Exchange Board of India’s (SEBI) board of directors approved the framework for Gold Spot trading in India. This move comes after Finance Minister Nirmala Sitharaman said in the budget that SEBI will be the regulator for spot gold markets.

Our Director, Ketan Kothari and Head – Research, Renisha Chainani had already informed and discussed on 17 July 2021 on CNBC Awaaz show, that SEBI will soon be approving Gold spot exchange and EGR in few months. To watch this show, click on this link https://www.youtube.com/watch?v=1Z-Wynd1Bk4&t=1s

EGR and its trading

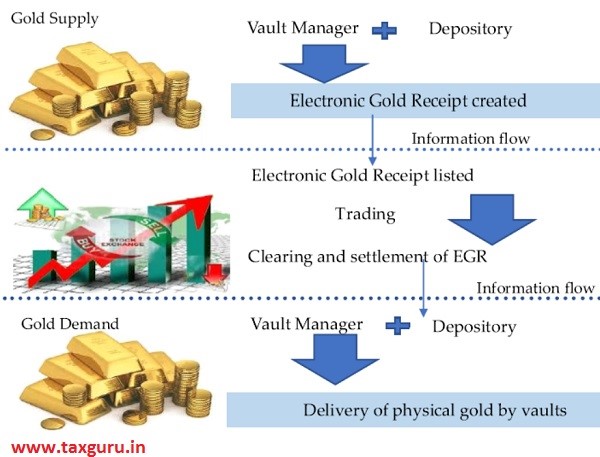

SEBI has proposed that “Electronic Gold Receipts” (EGR), which are gold-based products, be notified as securities. That implies they’ll have the same trading, clearing, and settlement capabilities as other securities traded on exchanges. Under the Securities Contracts (Regulation) Act 1956, EGRs will be notified as securities.

EGRs can be traded in a separate section on any recognised stock or commodity exchange, both old and new. The exchanges, with SEBI’s consent, can decide on the denomination (for example, 1 gram, 2-gram, 10 grams, etc.) for trading EGR and conversion of EGR into gold.

Vault Manager functions

Corporate entities having net worth of at least Rs 50 Crore can be registered as Vault managers and will be regulated as a SEBI intermediary for providing vaulting services for gold deposited to build EGRs.

Accepting deposits, storing and protecting gold, creating and withdrawing EGR, grievance redressal, and periodic reconciliation of physical gold with depository records will be the responsibilities of the vault manager. The clearing corporation will settle exchange transactions by transferring EGRs and funds to the buyer and seller, respectively.

Tranches of EGR Transaction

- First Tranche: Conversion from Physical Gold to EGR

- Second Tranche: Trading of EGR on exchange

- Third Tranche: Conversion from EGR to Physical Gold

EGR validity

Because EGRs have perpetual validity, the EGR holder can keep the EGRs for as long as they like. If an EGR holder wishes to convert it to the underlying gold, they must surrender the instrument to a vault manager. SEBI claimed EGRs will be made “fungible” and “interoperability amongst vault managers” will be allowed to reduce the costs associated for withdrawing gold from vaults.

Benefit of Gold Spot Exchange to Bullion Industry

This move is welcomed by Bullion industry as it will bring transparency and safety to gold transactions. Currently, different states have different gold prices. The gold exchange will provide a single market with an uniform pricing throughout the country. It will also broaden the range of investment possibilities available to investors. People can currently invest in gold ETFs, trade gold futures, and purchase the sovereign gold bond, which pays a 2.5 percent interest rate. While sovereign bonds pay interest, they have limited liquidity, which may favour the gold market.

The gold exchange is projected to provide a slew of benefits to both value chain participants and the broader gold market ecosystem, including efficient and transparent price discovery, investment liquidity, and assurance of gold purity, among other things.

You may also like to read: Digital Gold is here to stay – SEBIs circular is a reminder of Dos and Don’ts of enabling digital gold by brokers