By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold surged 18% between March 1 and April 12, rising around $400 and hitting new all-time highs of $2448 on escalating Middle East tensions, the Chinese gold rush, record purchases by central banks, concerns over sticky inflation, soaring U.S. government debt, and continued fiat debasement.

But then gold corrected almost 6% to trade below $2300 in the last week of April. This was a healthy correction in a long-term bull market. The factors which supported the price rally in March and April will continue for the rest of 2024 too.

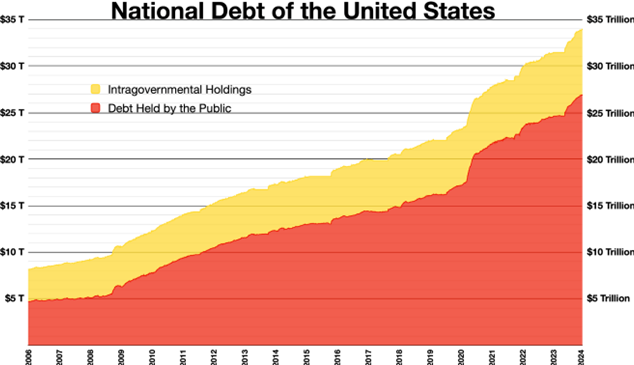

From the last Akshaya Tritiya, Gold prices have moved from Rs 60800 to Rs 70700, almost 16% YoY returns. Gold prices have given phenomenal returns in the last 20 years by rising more than 12x from Rs 5800/10 gm to Rs 70700/10 gm with a CAGR average return of more than 12%. Now the question is whether gold has discounted all positive news and fall from here going forward or if is there steam left in this bull rally. I would advise, that one of the most important triggers, one should pay close attention is to alarmingly high U.S. debt levels, which will be above $34.5 trillion by April 2024 and rising $1 Trillion every 100 days.

Ballooning US Debt – Elephant in the Room

Concern about the rapidly rising U.S. government debt is also one of the main reasons for elevated gold prices. The U.S. debt has crossed the $34 trillion mark in 2024, with interest payments projected to reach $870 billion in 2024, underscoring the urgency of fiscal management. In the US, debt is growing faster than the economy and the debt-to-GDP ratio is above 125.

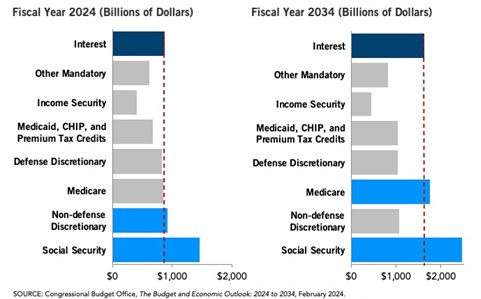

The primary cause for concern is the unregulated build up of the United States government’s debt, as interest payments continue to consume a bigger portion of the government’s budget, often surpassing that allocated to national defence.

In 2019, the annual debt interest payment was $300 billion. And we have reached a stage where a substantial amount of the budget is been allocated to interest payments. In the upcoming year, interest payments will account for about $1 trillion of the U.S. government’s spending, surpassing even the amount spent on national defence. If this keeps up, the federal government may spend more on interest over the course of the next ten years than on discretionary non-defence spending, which includes money for general government, transportation, veterans, education, health, international affairs, natural resources and the environment, general science and technology, and international affairs.

The FED now has four alternatives to lower this alarming debt: raising taxes, cutting spending, lowering interest rates, or going into default. Because the first two choices are a little more challenging to implement, the US depends on low-interest rates to fund its government. The United States would also become practically bankrupt as a nation if interest rates were to increase substantially higher than they already are. At that point, the Fed would come under political pressure from the federal government to peg the yield curve across the curve. When US 30-year bonds were fixed at 2% in the 1930s and 1940s, this was previously done. The Federal Reserve will persist in creating an infinite quantity of money to purchase an infinite quantity of bonds at a specific yield point.

In addition, the Fed is given new authority and responsibilities virtually every year. The Federal Reserve, in my opinion, is already way too strong an organization that is not accountable to anybody. It contributes to the issue. With its unprecedented potential to influence both national and international economies, the Federal Reserve has emerged as the world’s most powerful institution. After downgrading U.S. debt twice already this year—by Fitch in August and Moody’s in November—a third rating would cause more investors to switch from the dollar to other currencies or gold as a crisis hedge.

So to conclude the next big trigger for Gold that would take prices to $3000 in the next 2-3 years would be the US Debt crisis. The United States will be unable to pay its debts if it defaults, disrupting the world’s financial markets and leading to catastrophe. Investors will probably keep turning to gold in the case of a debt crisis to protect their capital from the consequences. Gold is a good investment at any price since it’s best seen as a long-term asset.

Investors should not skip a chance to buy gold on Akshaya Tritiya on dips around $2200-$2250 (~Rs 68000-69000), which would be a base price for the next 2-3 years. It is forecasted that gold prices will be trading 10% higher to around $2500 (~Rs 75500) from the current levels by the next year. So those who missed the earlier rally can jump on the train this month for good long-term returns.

For a better risk-adjusted return portfolio, it is always advised to allocate at least 15-20% of the portfolio amount into Gold and Silver divided equally. The best way to start or stay invested in gold systematically is through Augmont Digital Gold SIP for better returns.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice