By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Gold and Silver have been the best-performing asset class in 2024, touching record high levels of $2772 (~Rs 78900) and $35 (~Rs 100,000) mark respectively this month. Let’s look at returns on precious metals from previous Diwali.

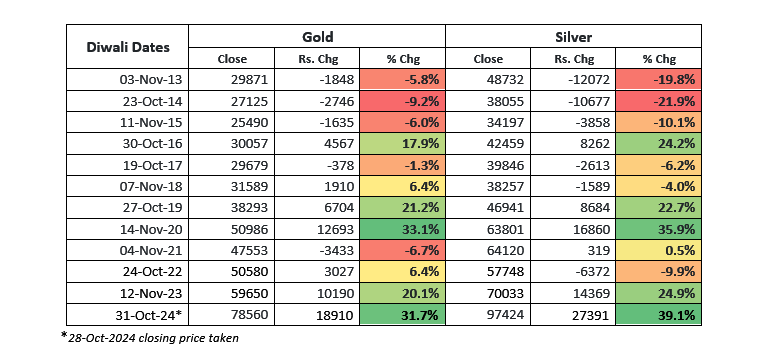

Returns on Gold and Silver Diwali to Diwali

Factors for precious Metals rally

The top five factors which have contributed to gold rallying of more than 30% and Silver rallying around 40% from last Diwali, making it one of the year’s best-performing asset classes are.

- Middle East tensions and the warlike situation in Russia-Ukraine and Iran-Israel have been the main reason for the safe-haven demand for precious metals in 2024.

- Interest rate cuts by various central banks globally like FED, ECB, PBoC, etc to combat high inflation and growth, have led to monetary easing and liquidity in the system, leading to speculative demand for precious metals.

- 2024 has been an election year where more than 60% of the world population went to /will be going to polling booths. US Elections have brought a lot of political uncertainty where there is neck-to-neck competition between US presidential candidates- Donald Trump and Kamala Harris – both have opposing opinions on important economic issues like tax cuts, tariffs, and international trade relations, especially with China.

- Growing fiscal deficits and debt levels mainly in the US have also boosted demand for precious metals.

- Interest in the prospect of de-dollarization—a move away from dependence on the U.S. dollar in international commerce and finance—has increased as a result of recent talks among the BRICS countries (Brazil, Russia, India, China, and South Africa) and other rising economies.

Strategy for Buying Precious Metals this Dhanteras/Diwali

- As Gold and Silver prices are trading at record high levels, it is advised to buy precious metal as an auspicious token amount this Dhanteras/Diwali in the form of physical gold/silver coin, a few units of Gold ETF or some token amount in Digital Gold/Digital Silver.

- One should wait for the Gold and Silver prices to correct and retrace to about $2500(~ Rs 72000) and $31 (~Rs 88500) respectively in November/December and then accumulate precious metals at those levels.

- One should at least allocate 20% of the investment portfolio in precious metals with 10-15% in gold and 5-10% in Silver. The best way to increase allocation into precious metal is to start the SIP or increase the amount in your Gold and Silver systematic purchases every month.

- All the factors mentioned for the bullish rally in precious metals will continue ahead supporting the prices to continue their northward journey except the political uncertainty due to elections.

- Gold and Silver prices are expected to continue their uptrend in the next few months for the target of $3000(~Rs 85000) and $38(~Rs 115,000) respectively. So the strategy should be buying on dips at the mentioned levels for a 20% upside target in the next few months.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice