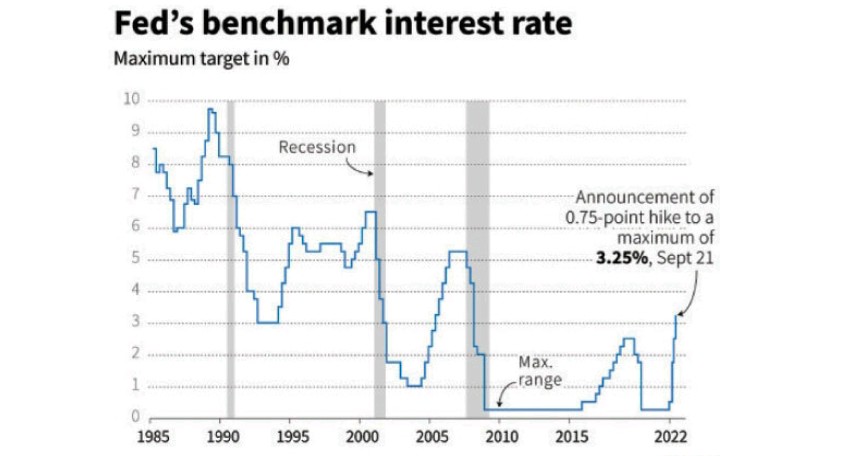

As expected, the FED hiked its benchmark interest rate by 75 bps to 3.25% this week. FED Chairman Jerome Powell has pledged to reduce inflation and restore price stability. A number of other major central banks raised interest rates this week, pushing government bond yields higher. This adds to the downward pressure on non-yielding gold. Despite another hefty rate hike by the Federal Reserve, precious metals prices are struggling this week.

Powell appears to want to emulate previous Fed chairman Paul Volcker after pursuing ultra-loose monetary policy that fuelled price instability and enormous inflation in the first place. Volcker raised interest rates to their highest level on record in the early 1980s, eventually halting the late 1970s inflation rise.

For the time being, the FED’s rate hikes and strong language on inflation are boosting the US Dollar Index. However, growing unemployment, declining factory output, dropping house sales, and poor GDP estimates in upcoming reports could indicate a harsh landing for the economy. This would effectively compel central bankers to relent.

Precious metals markets, on the other hand, haven’t exactly been generating stellar returns of late. They have been hampered all year by FED rate hikes, which have increased the value of the US dollar relative to other currencies. And, because markets are always looking forward, we can expect currency and precious metals markets to start reflecting a dovish FED tilt before it occurs. Investors who wait until the FED says that it has completed its rate hikes before positioning themselves for a falling dollar would certainly miss out on some solid gains in hard assets.

Nonetheless, the danger of escalation in the Russia-Ukraine war lends some support to the safe-haven precious metal. Russian President Vladimir Putin announced an emergency partial military mobilisation, which, coupled with economic fears, is weighing on investor sentiment and may limit gold losses.

A persistent break below the previous YTD low, in the $1650 range, could be interpreted as a new trigger for bearish traders. This could have already set the stage for further losses. As a result, a following drop towards the next significant support level, around $1600, is a distinct possibility.

However, there have been some bullish divergences building in recent weeks, particularly in the Silver market. Silver is displaying some relative strength in comparison to financial assets, other commodities, and gold. Since the beginning of the month, Silver has made some movement on the charts. Bulls have cause to be optimistic, and they believe silver will shortly convincingly break over the $20 mark.