Fundamental News and Triggers

- The US has put a 104% tariff on Chinese goods, raising tensions between the world’s two largest economies and causing market volatility. The White House acknowledged that the new tariff structure, which takes effect on April 9, follows President Donald Trump’s ultimatum to Beijing to reverse its retaliatory 34% taxes on American imports.

- This adds to concerns that an all-out trade war could force the global economy into a recession, triggering a new wave of risk-aversion trading and reviving demand for the safe-haven gold price.

- Investors increased their bets that a tariff-induced US economic slowdown would prompt the Federal Reserve to resume its rate-cutting cycle shortly. The CME Group’s FedWatch Tool indicates that traders are pricing in a more than 60% possibility that the Fed will decrease borrowing costs in May. Furthermore, the US central bank is predicted to provide five rate cuts by 2025.

Technical Triggers

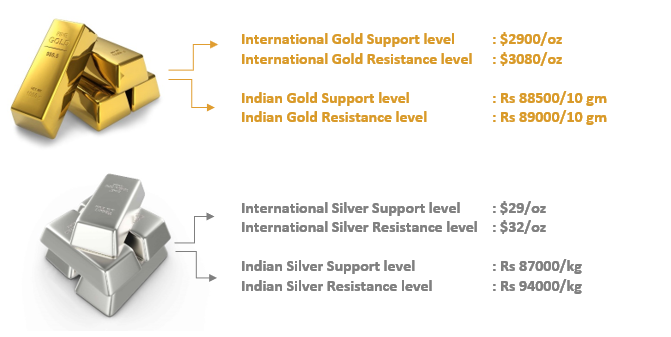

- The gold active June contract has significant support at $3000 (~Rs 87000). However, if prices remain below $3000, they may fall below $2900 (~Rs 84500).

- Silver has excellent support at $29 (about Rs 87000). I do not believe Silver can remain below this level. Every decline below $30 (~Rs 89000) should be viewed as a buying opportunity for targets of $32 (~Rs 94000).

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.