Fundamental News and Triggers

- The US macro data dump yesterday revealed a halted rate of inflation and a relatively robust US economy. This raises the possibility that the Fed may be wary of further rate reduction and cause a slight increase in the rates on US Treasury bonds, which boosts demand for the US dollar and is seen to be hurting Gold and Silver.

- According to data from the US Commerce Department, the largest economy in the world grew at a robust 2.8% annual rate in the third quarter thanks to a 3.5% increase in consumer expenditure. And the core PCE Price Index increased by 0.3% monthly, moving up from 2.7% in September to 2.8% last month.

- In addition to FOMC minutes that indicate the Committee may halt its reduction of the policy rate if inflation stays high, there are concerns that US President-elect Donald Trump’s plans may increase inflation.

Technical Triggers

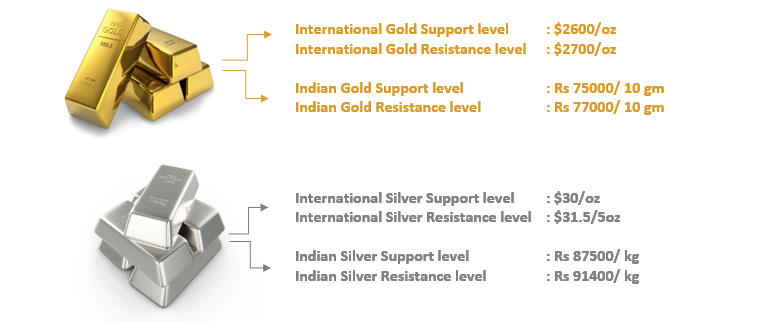

- Gold is showing very volatile moves with support at $2600. Prices are expected to trade in the range of $2600 (~Rs 75000) and $2700(~Rs 77000) for the next few days.

- As suggested, Silver has strong support at $30 (~Rs 87500), prices have rebounded and are expected to consolidate between Rs 88000 and Rs 92000 for the next few days.

Support and Resistance

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.