By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Due to concerns about a global trade war and Trump’s tariffs, the price of gold continues to be optimistic. The Dollar Index is impacted by falling US bond yields, which also give the precious metal more support.

In addition to the 10% tax on Chinese imports and the 25% tariff on steel and aluminium, President Donald Trump has since taking office on January 20 announced intentions to impose further tariffs on timber, automobiles, semiconductors, and pharmaceuticals, further intensifying tensions in international trade.

Increasing geopolitical concerns, there have been rumours that Trump may sideline Kyiv and its European allies in talks with Russia by withdrawing US support for Ukraine. Wednesday’s social media flurry between US President Donald Trump and Ukrainian President Volodymyr Zelenskiy marked a new low in the two countries’ relationship. Since Russia invaded Ukraine’s neighbour in 2022, there are increasing worries that Trump may end US assistance for the country. Volodymyr Zelenskiy has “better move fast” to negotiate an agreement with Russia, he stated on social media on Wednesday, “or he is not going to have a country left.” Thus, geopolitical uncertainty is being increased.

Minutes from the last FOMC policy meeting held in January released on Wednesday revealed officials noted a high degree of uncertainty that requires the central bank to take a careful approach in considering any further interest rate cuts.

Additional events about the crisis between Russia and Ukraine may potentially have an impact on Gold’s performance. Trump referred to Ukrainian President Volodymyr Zelenskiy as a “dictator without elections” in a social media post, and he warned him to act quickly or face losing his nation. According to Reuters’ reporting on the matter, “the Trump administration’s Ukraine moves in recent days have left European officials shocked and flat-footed.” Another leap up in gold prices might be triggered by a further escalation of geopolitical tensions, with the US and the EU at odds on how to resolve the crisis.

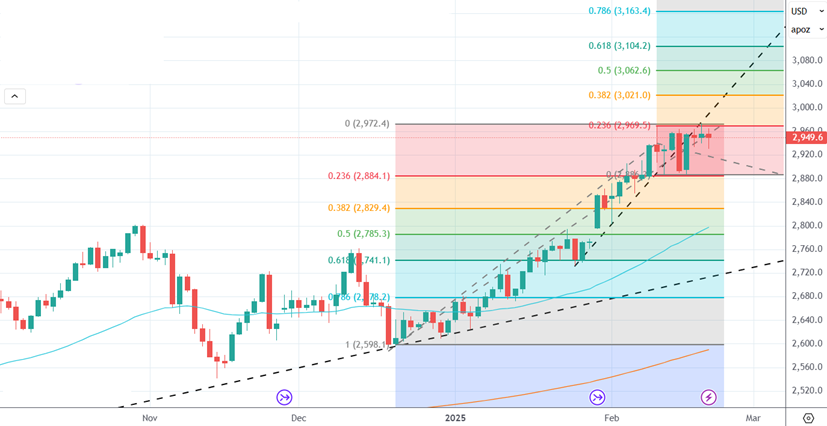

Gold Apr Futures traded at a new record high of $2973 (~Rs 83560) on Thursday, having cleared the resistance of $2965 (~Rs 86300) on the continued uncertain environment of tariffs. Prices are moving towards the next psychological resistance, targeting $3000 (~Rs 87200-300) and beyond. USD INR appreciation may limit gains in domestic markets.

Gold Apr Futures Daily Chart

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.