By Dr. Renisha Chainani, Head-Research, Augmont – Gold for All.

Gold has been mined by humans for about 7000 years. The valuable metal still requires a lot of work to get to market. The development of a mine can take anywhere between 10 and 20 years after a gold deposit is discovered. Production could go on for several years or many decades.

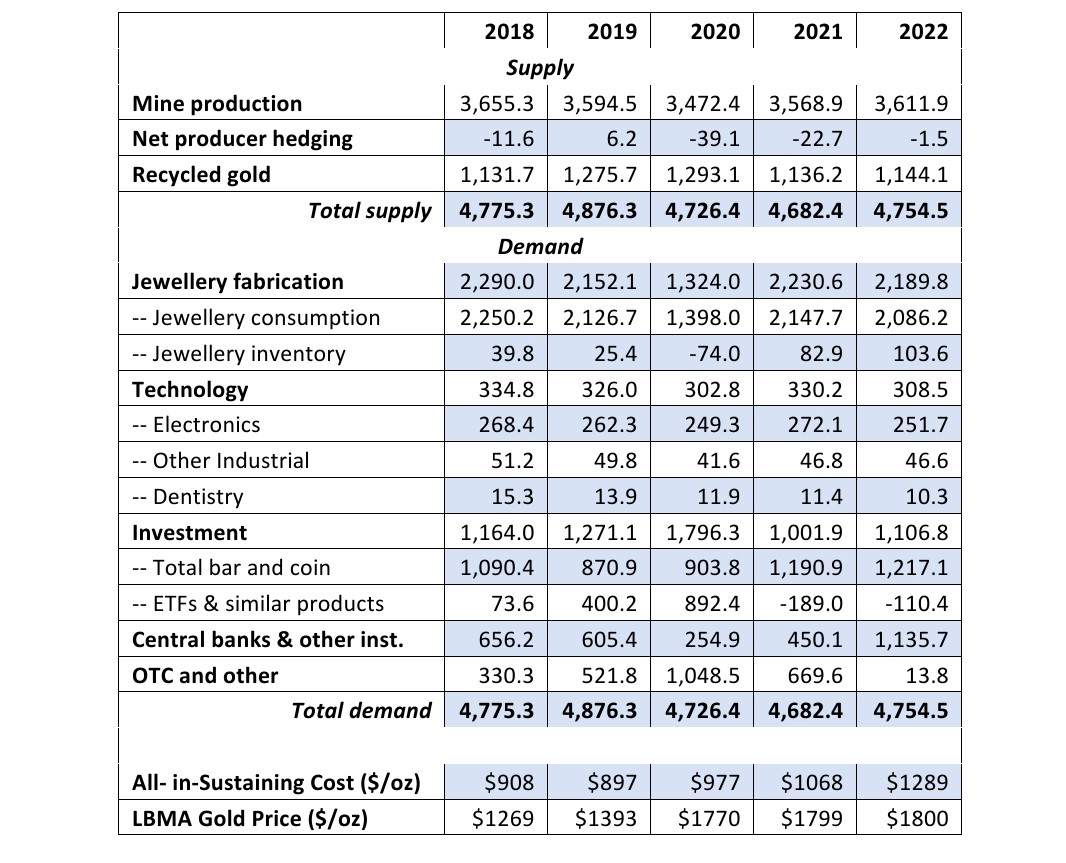

Gold Demand and Supply

Source : World Gold Council

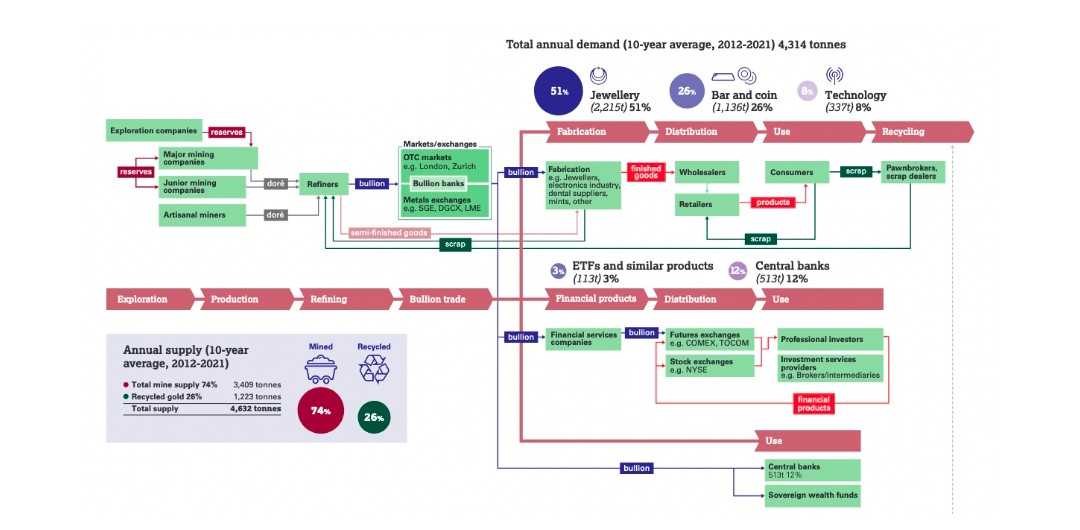

Gold supply is in the range of 4700-4800 tonnes in the last few years, from which, 74% comes through mines and 26% through recycling.

- Three different types of costs make up all-in-sustaining costs (AISC), starting with cash costs, which include only the costs of extraction and processing. The second category is the all-in cash costs, which include royalties in addition to the costs of exploration, financing, administration, and obtaining production rights. All costs associated with the development and maintenance of a mine are included in the third cost component.

- In 2000, the AISC for producing an ounce of gold was approximately $300; however, since then, the costs have increased almost continuously. They had already risen to about $900/oz by 2012, and in the third quarter of 2022, they attained their highest point to date: $1289/oz

- Metal royalty and streaming companies finance gold exploration companies/mines in exchange for future payoffs. Royalty companies receive a fixed percentage of a mine’s revenue, whereas streaming companies receive the physical metal.

- Gold Exploration companies provide gold dore bars to Gold Refiners, who in turn refine it to either 999 finness pure gold bars or semi-finished goods.

- Pure Gold bars are supplied to Bullion banks, Bullion exchanges for trading while semi-finished goods are supplied to fabricators.

- Bullion banks act as a one-stop marketplace for bullion market players providing services like trading, vaulting, risk management, hedging, market making and providing working capital finance to jewellery manufacturers through Gold Metal Loans.

- Fabricators can be jewellers, mints, dental suppliers or the electronic industry. Jewellery constitutes around 50% demand for gold worldwide with over 2200 tonnes.

- Bar and coin constitute around 25% of gold demand with 1200 tonnes every year, while Technology constitutes just 8%.

- Central Banks are major consumers of refined gold from bullion banks constituting 12% of the gold demand. 2022 was the year when Central Bank gold buying was at 55 year high due to global uncertainty and 40-year high inflation.

- Rest 3% of demand comes from gold trading on exchanges and ETFs by professional and retail investors.

Lifecycle of Gold

Source: World Gold Council

1 Comment. Leave new

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?