By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Precious metals fell substantially as international tensions escalated earlier this week. The unwinding of the Japanese Yen carry trade, mounting worries of a US recession, and heightened concerns about a worsening conflict in the Middle East spurred a worldwide market selloff on Monday, producing huge losses in several financial assets, except for the JPY.

Gold and silver managed to contain their losses on Wednesday, but investors’ attention switched to risk-sensitive assets as fears over the continuance of the unwinding of the JPY carry trade subsided. Bank of Japan Deputy Governor Shinichi Uchida stated that when markets are unstable, they will refrain from raising the policy rate, citing the need to maintain the existing level of monetary stimulus for the time being.

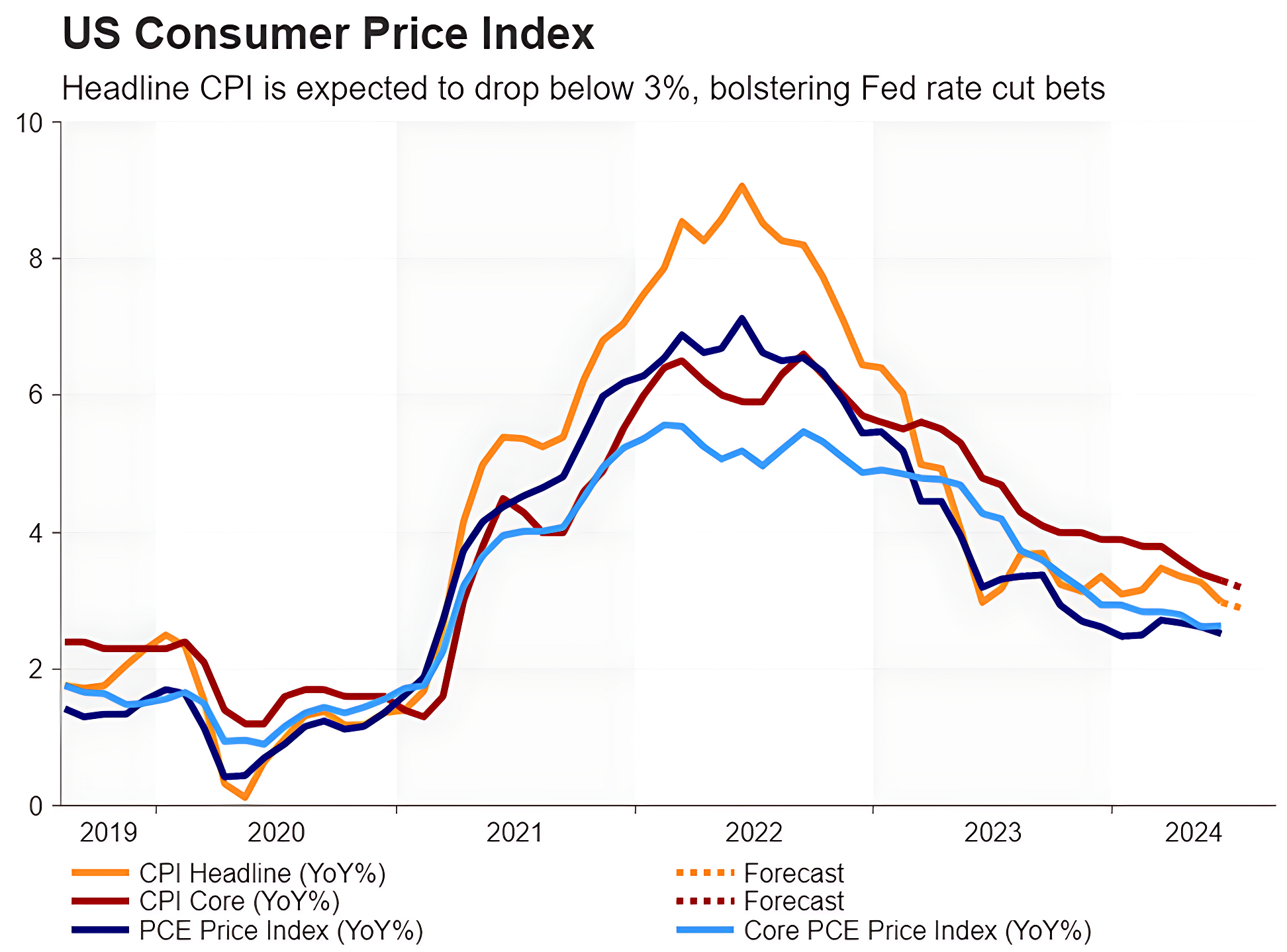

The fear that the US economy is on the cusp of a recession has partly subsided, but markets remain tense. Investors believe that the Fed’s delay in lowering interest rates has made an economic downturn likely. Sticky inflation is the primary reason why the Fed has remained so cautious. However, inflationary pressures appear to be gradually easing.

Next week’s CPI report is likely to highlight this structure, and in the absence of any shocks, the data may not do much to alleviate slowdown concerns, as the attention has switched to the growth side of the story. Inflationary shocks, whether positive or negative, can have significant consequences.

According to the CME FedWatch Tool, markets anticipate a greater than 50% chance of a 50-basis point Federal Reserve rate drop in September. If the monthly core CPI increases faster than expected, investors may reconsider the possibility of a 50-basis point decrease in September, allowing the USD to gain momentum in the short term. On the other hand, a reading at or below market expectations in this data might weigh on the USD, paving the way for another move higher in gold. Meanwhile, market investors will continue to closely monitor developments surrounding the Iran-Israel dispute. When global tensions rise, gold becomes one of the most sought-after investments.

Gold Weekly chart

From the technical perspective, Gold has a strong support of around Rs 69000 and resistance of around Rs 71000. Prices need to break this range for either side direction, but the bias remains towards the upside.

Silver Weekly chart

Silver prices have retraced from 61.8% to Rs 79000 in its rally of 2024 from Rs 68000 to its record high of Rs 96000. Rs 79000 is very strong support, which Silver should not break to continue its uptrend towards Rs 82000 and Rs 85500.

Disclaimer: This report contains the author’s opinion, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The opinions mentioned above are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.