Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Positive – – Gold and Silver prices are seeing rebound and cleared their recent highs. Next resistance for gold is $1800 and for Silver $23

Long-term View (3-4months) – Positive – –Any dips towards 51000 and 55000 should be used as buying opportunities for the target of 55000 and 65000 for Gold and Silver respectively in long-term.

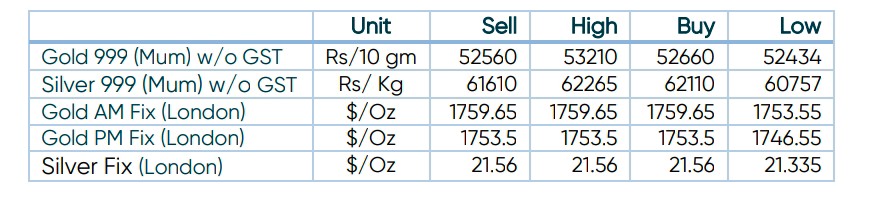

SPOT Prices

SPOT Gold 4 Daily Price Chart

SPOT Silver 4 Daily Price Chart

Important News and Triggers

International News –––Bullion prices rose over 1% reinforced by Federal Reserve Chair Jerome Powell’s comments. He said that the Fed could scale back the pace of its interest rate hikes “as soon as December”, while warning the fight against inflation was far from over.

China premium – Gold in China has been trading at a huge premium to international prices as improved demand exceeds the country’s imports, which are constrained by quotas. Only accredited banks in the country are allowed to import gold, with quantities set by the People’s Bank of China.

Central bank buying – The latest data from the WGC shows that central banks increased their buying of gold significantly over the third quarter. Central banks bought 399 tonnes in 3Q22, which is up 341% year-on-year and also a record quarterly amount. The data shows that Turkey, Uzbekistan, India and Qatar were the largest buyers of gold over the quarter,

Disclaimer

1 Comment. Leave new

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.