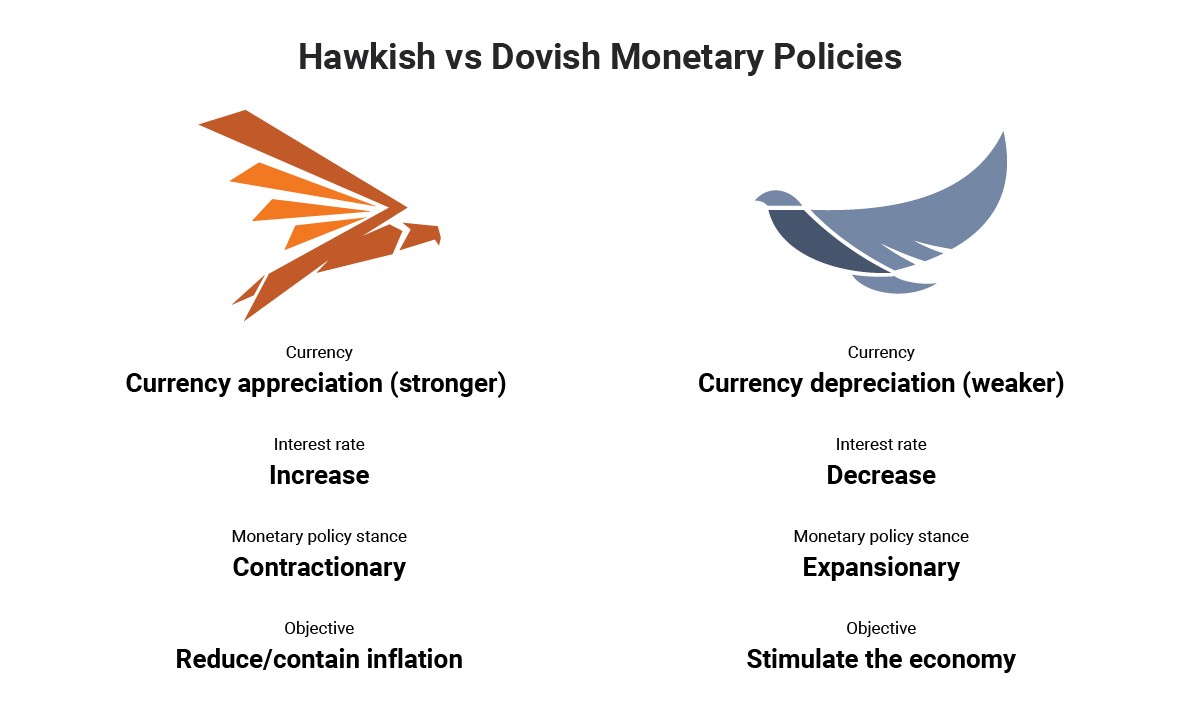

You have probably heard a financial news presenter say something along the lines of “The central bank governor came out slightly hawkish today after bouts of strong economic data”. The terms Hawkish and Dovish refer to whether central banks are more likely to tighten (hawkish) or accommodate (dovish) their monetary policy.

WHAT DOES HAWKISH MEAN?

The term hawkish is used to describe contractionary monetary policy. Central bankers can be said to be hawkish if they talk about tightening monetary policy by increasing interest rates or reducing the central bank’s balance sheet. A monetary policy stance is said to be hawkish if it forecasts future interest rate increases. Central bankers can also be said to be hawkish when they are positive about the economic growth outlook and expect inflation to increase

Some words that could be used describing a hawkish monetary policy include:

- Strong economic growth

- Inflation increasing

- Reducing the balance sheet

- Tightening of monetary policy

- Interest rate hikes

WHAT DOES DOVISH MEAN?

Dovish refers to the opposite. When central bankers are talking about reducing interest rates or increasing quantitative easing to stimulate the economy they are said to be dovish. If central bankers are pessimistic about economic growth and expect inflation to decrease or become deflation and they signal this to the market through their projections or forward guidance, they are said to be dovish about the economy.

Some words that could be used to describe a dovish monetary policy, include:

- Weak economic growth

- Inflation decreasing/deflation (negative inflation)

- Increasing the balance sheet

- Loosening of monetary policy

- Interest rate cuts

A slight shift in tone from a central banker could have drastic consequences on markets especially Currency, Bonds, and Gold. Traders often monitor Federal Open Market Committee meetings and minutes to look for slight changes in language that could suggest further rate hikes or cuts and attempt to take advantage of this. The hawkish tone of the Central bank is generally considered to be negative for precious metals, while the dovish tone is considered to be positive for precious metals.

92 Comments. Leave new

Наиболее актуальные новости моды.

Исчерпывающие события самых влиятельных подуимов.

Модные дома, бренды, высокая мода.

Самое лучшее место для модных хайпбистов.

https://fashionvipclub.ru/news/2024-06-19-gruzin-kotoryy-perevernul-mirovuyu-modu-demna-gvasaliya/

Точно трендовые события модного мира.

Все новости известнейших подуимов.

Модные дома, торговые марки, haute couture.

Интересное место для модных хайпбистов.

https://hypebeasts.ru/

Абсолютно важные события индустрии.

Исчерпывающие мероприятия всемирных подуимов.

Модные дома, торговые марки, высокая мода.

Лучшее место для стильныех людей.

https://luxe-moda.ru/chic/162-loro-piana-lyubimyy-brend-politikov-i-biznesmenov/

Точно важные новости модного мира.

Важные эвенты мировых подуимов.

Модные дома, бренды, haute couture.

Самое лучшее место для трендовых хайпбистов.

https://km-moda.ru/style/525-parajumpers-istoriya-stil-i-assortiment/

Несомненно актуальные события мировых подиумов.

Актуальные эвенты мировых подуимов.

Модные дома, бренды, высокая мода.

Новое место для трендовых хайпбистов.

https://luxe-moda.ru/chic/356-rick-owens-buntar-v-chernyh-tonah/

Полностью стильные новости моды.

Актуальные мероприятия известнейших подуимов.

Модные дома, торговые марки, высокая мода.

Лучшее место для стильныех людей.

https://luxe-moda.ru/chic/356-rick-owens-buntar-v-chernyh-tonah/

Наиболее свежие новости моды.

Абсолютно все эвенты мировых подуимов.

Модные дома, лейблы, высокая мода.

Лучшее место для трендовых людей.

https://modastars.ru/

Полностью трендовые события мировых подиумов.

Важные новости мировых подуимов.

Модные дома, торговые марки, высокая мода.

Интересное место для модных хайпбистов.

https://donnafashion.ru/

Полностью свежие новинки мира fashion.

Актуальные события мировых подуимов.

Модные дома, лейблы, высокая мода.

Интересное место для стильныех людей.

https://donnafashion.ru/

Точно трендовые новинки модного мира.

Актуальные эвенты самых влиятельных подуимов.

Модные дома, лейблы, haute couture.

Приятное место для трендовых хайпбистов.

https://mvmedia.ru/novosti/282-vybiraem-puhovik-herno-podrobnyy-gayd/

Несомненно актуальные новинки модного мира.

Важные события всемирных подуимов.

Модные дома, торговые марки, гедонизм.

Интересное место для трендовых хайпбистов.

https://lecoupon.ru/

На этом сайте вы найдёте полезную информацию о лекарственном средстве Ципралекс. Вы узнаете здесь сведения о основных показаниях, дозировке и вероятных побочных эффектах.

http://NalvaKhurdIndia.eorg.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1

На данном сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, развитии событий и ключевых персонажах. однажды в сказке смотреть Здесь представлены подробные материалы о создании шоу, актерах и любопытных деталях из-за кулис.

На данном сайте вы найдёте полезную информацию о лекарственном средстве Ципралекс. Вы узнаете здесь информация о основных показаниях, дозировке и вероятных побочных эффектах.

http://Melani.omob.xyz/category/website/wgI2vZFhZf5rbhFqBTP7G0CD1

На данном сайте можно ознакомиться с информацией о телешоу “Однажды в сказке”, развитии событий и ключевых персонажах. смотреть однажды в сказке Здесь размещены подробные материалы о производстве шоу, актерах и фактах из-за кулис.

На данном сайте можно ознакомиться с информацией о сериале “Однажды в сказке”, развитии событий и ключевых персонажах. смотреть однажды в сказке Здесь размещены подробные материалы о производстве шоу, исполнителях ролей и фактах из-за кулис.

На данном сайте можно найти информацией о сериале “Однажды в сказке”, развитии событий и главных персонажах. https://odnazhdy-v-skazke-online.ru/ Здесь представлены интересные материалы о производстве шоу, актерах и любопытных деталях из-за кулис.

This comprehensive resource serves as an thorough guide to the realm of modern video surveillance, providing valuable insights for both experienced CCTV installers and security-conscious companies seeking to improve their security infrastructure.

Maillist Software

The site offers a detailed analysis of cloud-based video surveillance systems, reviewing their strengths, drawbacks, and practical applications.

Здесь размещены свежие события РФ и всего мира.

Здесь можно прочитать значимые статьи на различные темы.

https://ecopies.rftimes.ru/

Следите за ключевых событий каждый день .

Объективность и оперативность в каждом материале .

This site, you will find details about 1Win casino in Nigeria.

It includes various aspects, including the well-known online game Aviator.

https://1win-casino-ng.com/

You can also discover sports wagering opportunities.

Enjoy an exciting gaming experience!

Современная частная клиника обеспечивает высококачественные медицинские услуги всем пациентам.

Мы гарантируем персонализированное лечение и заботу о вашем здоровье.

Команда профессионалов в нашей клинике опытные и внимательные врачи, работающие с современным оборудованием.

Наши услуги включают широкий спектр медицинских процедур, в том числе медицинские услуги по восстановлению здоровья.

Забота о вашем здоровье — наши главные приоритеты.

Обратитесь к нам, и мы поможем вам вернуться к здоровой жизни.

prrush.com

Жителю мегаполиса важно быть в курсе актуальными тенденциями моды. В современном мире внешний вид играет важную роль. Одежда и стиль могут подчеркнуть индивидуальность. К тому же, тренды часто связаны с актуальными событиями. Регулярно обновляя гардероб, легче адаптироваться к любым ситуациям. Посещая показы мод или читая журналы, можно вдохновляться новыми идеями. В итоге, модные тренды позволяют идти в ногу со временем.

https://storjduco2.ddns.net/forums/viewtopic.php?t=93246103

Слоты — это одна из востребованных категорий развлечений в сфере гемблинга.

Основная суть игровых автоматов состоит в выпадении символов, что формируют выигрышные линии.

Каждый слот содержит отличающиеся механики, многочисленные знаки и дополнительные функции, которые делают игру интереснее.

Игровые автоматы подразделяются на традиционные и новые, в которых встречаются разные уровни сложности.

слоты новые

Многие игроки выбирают эти игры за интуитивность и возможность расслабиться с минимумом тактических решений.

Современные игровые механики обычно предлагают множество уникальных фишек, что привлекает новых пользователей.

Как результат, эти игры продолжают быть одним из самых востребованных способов весело провести время в гемблинге.

На данном ресурсе представлены популярные слот-автоматы.

Мы предлагаем лучшую коллекцию игр от популярных брендов.

Любой автомат обладает высоким качеством, призовыми раундами и честными шансами на выигрыш.

https://elbimusic.com/demystifying-the-world-of-online-casinos-2/

Пользователи могут играть в демо-режиме или выигрывать настоящие призы.

Интерфейс интуитивно понятны, что делает поиск игр быстрым.

Если вы любите азартные игры, данный ресурс стоит посетить.

Откройте для себя мир слотов — возможно, именно сегодня вам повезёт!

Men’s health involves unique considerations and preventative strategies. Understanding common conditions like prostate issues or heart disease risk is important. Learning about recommended screenings and healthy lifestyle choices is key. Familiarity with medical preparations often relevant to men’s health is useful. This might include treatments for erectile dysfunction or testosterone therapy. Finding reliable resources focused on men’s wellness encourages proactive care. The iMedix podcast covers health topics relevant to men’s specific needs. As one of iMedix’s popular podcasts, it addresses diverse demographics. Listen to the iMedix health news podcast for updates relevant to men. Find trusted health advice for men at www.iMedix.com.

Self-harm leading to death is a complex issue that impacts many families across the world.

It is often associated with mental health issues, such as depression, stress, or substance abuse.

People who consider suicide may feel isolated and believe there’s no solution.

how to commit suicide without pain

We must raise awareness about this topic and support those in need.

Mental health care can save lives, and finding help is a brave first step.

If you or someone you know is thinking about suicide, get in touch with professionals.

You are not alone, and support exists.

На этом сайте вы можете играть в обширной коллекцией игровых автоматов.

Игровые автоматы характеризуются яркой графикой и интерактивным игровым процессом.

Каждый слот предлагает уникальные бонусные раунды, повышающие вероятность победы.

1xbet игровые автоматы

Слоты созданы для игроков всех уровней.

Можно опробовать игру без ставки, после чего начать играть на реальные деньги.

Проверьте свою удачу и получите удовольствие от яркого мира слотов.

This website features a large variety of video slots, designed for different gaming styles.

Right here, you can discover retro-style games, new generation slots, and progressive jackpots with high-quality visuals and immersive sound.

Whether you’re looking for easy fun or love complex features, you’ll find what you’re looking for.

http://a-bcd.ru/news/204812/

Every slot are available 24/7, no download needed, and perfectly tuned for both all devices.

In addition to games, the site includes slot guides, welcome packages, and user ratings to enhance your experience.

Register today, jump into the action, and get immersed in the excitement of spinning!

На данной платформе вы обнаружите интересные онлайн-автоматы в казино Champion.

Коллекция игр представляет классические автоматы и актуальные новинки с качественной анимацией и разнообразными функциями.

Каждый слот оптимизирован для комфортного использования как на ПК, так и на мобильных устройствах.

Независимо от опыта, здесь вы сможете выбрать что-то по вкусу.

casino чемпион

Игры работают круглосуточно и не нуждаются в установке.

Дополнительно сайт предоставляет программы лояльности и обзоры игр, чтобы сделать игру ещё интереснее.

Погрузитесь в игру уже сегодня и испытайте удачу с играми от Champion!

На данной платформе представлены онлайн-игры платформы Vavada.

Любой игрок сможет выбрать подходящую игру — от классических игр до новейших моделей с яркой графикой.

Платформа Vavada открывает доступ к слотов от топовых провайдеров, включая слоты с крупными выигрышами.

Каждый слот запускается круглосуточно и подходит как для настольных устройств, так и для телефонов.

вавада регистрация

Каждый геймер ощутит азартом, не выходя из любимого кресла.

Интерфейс сайта понятна, что даёт возможность быстро найти нужную игру.

Начните прямо сейчас, чтобы погрузиться в мир выигрышей!

Here, you can access lots of slot machines from leading developers.

Players can try out classic slots as well as feature-packed games with stunning graphics and bonus rounds.

Even if you’re new or an experienced player, there’s something for everyone.

slot casino

Each title are ready to play anytime and optimized for desktop computers and smartphones alike.

You don’t need to install anything, so you can start playing instantly.

Site navigation is easy to use, making it simple to explore new games.

Join the fun, and enjoy the world of online slots!

Here, you can discover lots of casino slots from top providers.

Visitors can experience classic slots as well as feature-packed games with high-quality visuals and exciting features.

Even if you’re new or a seasoned gamer, there’s always a slot to match your mood.

money casino

The games are available round the clock and optimized for desktop computers and tablets alike.

All games run in your browser, so you can start playing instantly.

Site navigation is intuitive, making it quick to browse the collection.

Join the fun, and dive into the excitement of spinning reels!

Сайт BlackSprut — это одна из самых известных онлайн-площадок в даркнете, предоставляющая разные функции для пользователей.

На платформе доступна удобная навигация, а интерфейс не вызывает затруднений.

Гости ценят отзывчивость платформы и жизнь на площадке.

bs2best.markets

Площадка разработана на удобство и анонимность при использовании.

Кому интересны альтернативные цифровые пространства, BlackSprut может стать интересным вариантом.

Перед использованием не лишним будет прочитать основы сетевой безопасности.

Here, you can access lots of online slots from famous studios.

Visitors can enjoy retro-style games as well as modern video slots with vivid animation and bonus rounds.

If you’re just starting out or a casino enthusiast, there’s always a slot to match your mood.

casino games

Each title are available 24/7 and optimized for laptops and tablets alike.

You don’t need to install anything, so you can jump into the action right away.

Site navigation is user-friendly, making it convenient to browse the collection.

Join the fun, and discover the world of online slots!

Наш веб-портал — интернет-представительство независимого сыскного бюро.

Мы организуем помощь в области розыска.

Штат сотрудников работает с максимальной конфиденциальностью.

Нам доверяют сбор информации и анализ ситуаций.

Нанять детектива

Любой запрос обрабатывается персонально.

Опираемся на новейшие технологии и работаем строго в рамках закона.

Если вы ищете настоящих профессионалов — добро пожаловать.

Онлайн-площадка — сайт независимого расследовательской службы.

Мы предоставляем сопровождение в решении деликатных ситуаций.

Команда профессионалов работает с максимальной дискретностью.

Нам доверяют наблюдение и выявление рисков.

Услуги детектива

Любая задача обрабатывается персонально.

Задействуем современные методы и соблюдаем юридические нормы.

Ищете достоверную информацию — добро пожаловать.

Наш веб-портал — цифровая витрина профессионального расследовательской службы.

Мы предлагаем услуги в решении деликатных ситуаций.

Штат опытных специалистов работает с абсолютной дискретностью.

Мы берёмся за наблюдение и детальное изучение обстоятельств.

Детективное агентство

Каждое дело получает персональный подход.

Мы используем проверенные подходы и ориентируемся на правовые стандарты.

Если вы ищете реальную помощь — вы нашли нужный сайт.

Этот сайт — сайт частного аналитической компании.

Мы предлагаем поддержку по частным расследованиям.

Штат детективов работает с абсолютной этичностью.

Нам доверяют сбор информации и разные виды расследований.

Детективное агентство

Любой запрос получает персональный подход.

Применяем новейшие технологии и ориентируемся на правовые стандарты.

Нуждаетесь в ответственное агентство — вы нашли нужный сайт.

Наш веб-портал — официальная страница лицензированного аналитической компании.

Мы организуем услуги в сфере сыскной деятельности.

Команда сотрудников работает с абсолютной этичностью.

Нам доверяют наблюдение и разные виды расследований.

Детективное агентство

Каждое обращение рассматривается индивидуально.

Задействуем новейшие технологии и работаем строго в рамках закона.

Ищете ответственное агентство — свяжитесь с нами.

Here offers a diverse range of decorative wall clocks for your interior.

You can discover minimalist and classic styles to complement your apartment.

Each piece is carefully selected for its craftsmanship and durability.

Whether you’re decorating a stylish living room, there’s always a perfect clock waiting for you.

hunter green kit cat wall clocks

The collection is regularly renewed with new arrivals.

We focus on a smooth experience, so your order is always in safe hands.

Start your journey to perfect timing with just a few clicks.

This online store offers a large assortment of interior wall clocks for any space.

You can explore modern and classic styles to enhance your living space.

Each piece is hand-picked for its craftsmanship and accuracy.

Whether you’re decorating a creative workspace, there’s always a beautiful clock waiting for you.

best karlsson modern wall clocks

Our catalog is regularly updated with new arrivals.

We care about secure delivery, so your order is always in professional processing.

Start your journey to better decor with just a few clicks.

Данный ресурс — официальная страница независимого расследовательской службы.

Мы предоставляем поддержку по частным расследованиям.

Штат профессионалов работает с максимальной осторожностью.

Мы берёмся за проверку фактов и разные виды расследований.

Заказать детектива

Любой запрос обрабатывается персонально.

Опираемся на эффективные инструменты и ориентируемся на правовые стандарты.

Нуждаетесь в реальную помощь — добро пожаловать.

This online service provides many types of pharmaceuticals for easy access.

Customers are able to securely get needed prescriptions with just a few clicks.

Our catalog includes popular drugs and custom orders.

Everything is provided by licensed pharmacies.

https://www.provenexpert.com/raxtozin-online/

We prioritize quality and care, with secure payments and fast shipping.

Whether you’re managing a chronic condition, you’ll find safe products here.

Explore our selection today and enjoy trusted access to medicine.

On this platform, you can discover lots of casino slots from leading developers.

Users can enjoy classic slots as well as modern video slots with stunning graphics and bonus rounds.

Whether you’re a beginner or a casino enthusiast, there’s always a slot to match your mood.

casino slots

Each title are instantly accessible 24/7 and designed for PCs and mobile devices alike.

All games run in your browser, so you can start playing instantly.

Platform layout is easy to use, making it quick to explore new games.

Sign up today, and dive into the world of online slots!

On this platform, you can find a great variety of casino slots from leading developers.

Users can try out classic slots as well as feature-packed games with high-quality visuals and bonus rounds.

If you’re just starting out or an experienced player, there’s something for everyone.

slot casino

All slot machines are instantly accessible round the clock and optimized for PCs and tablets alike.

You don’t need to install anything, so you can start playing instantly.

The interface is intuitive, making it simple to explore new games.

Register now, and discover the thrill of casino games!

Лето 2025 года обещает быть стильным и инновационным в плане моды.

В тренде будут натуральные ткани и минимализм с изюминкой.

Актуальные тона включают в себя природные тона, подчеркивающие индивидуальность.

Особое внимание дизайнеры уделяют аксессуарам, среди которых популярны макросумки.

https://kyourc.com/post/152910_luxury-fashion-lives-here-https-lepodium-ru-lepodium-style-fashion-luxury.html

Возвращаются в моду элементы модерна, интерпретированные по-новому.

В новых коллекциях уже можно увидеть захватывающие образы, которые вдохновляют.

Следите за обновлениями, чтобы встретить лето стильно.

This website, you can access a great variety of casino slots from famous studios.

Visitors can try out classic slots as well as feature-packed games with vivid animation and bonus rounds.

Even if you’re new or an experienced player, there’s a game that fits your style.

play aviator

The games are available 24/7 and designed for desktop computers and smartphones alike.

No download is required, so you can jump into the action right away.

The interface is easy to use, making it convenient to explore new games.

Join the fun, and dive into the excitement of spinning reels!

Did you know that 1 in 3 medication users commit preventable drug mistakes stemming from lack of knowledge?

Your wellbeing should be your top priority. All treatment options you implement significantly affects your body’s functionality. Staying educated about medical treatments isn’t optional for disease prevention.

Your health goes far beyond swallowing medications. Every medication interacts with your body’s chemistry in unique ways.

Remember these critical facts:

1. Combining medications can cause dangerous side effects

2. Even common allergy medicines have strict usage limits

3. Self-adjusting treatment reduces effectiveness

For your safety, always:

✓ Verify interactions using official tools

✓ Review guidelines in detail before taking new prescriptions

✓ Consult your doctor about correct dosage

___________________________________

For professional medication guidance, visit:

https://pando.life/article/1021966

Our e-pharmacy features an extensive variety of medications at affordable prices.

You can find all types of drugs for all health requirements.

We strive to maintain high-quality products while saving you money.

Speedy and secure shipping ensures that your purchase gets to you quickly.

Enjoy the ease of shopping online on our platform.

vidalista 10

Here, you can discover a great variety of casino slots from famous studios.

Players can try out retro-style games as well as feature-packed games with vivid animation and bonus rounds.

Whether you’re a beginner or a seasoned gamer, there’s something for everyone.

play aviator

All slot machines are instantly accessible round the clock and compatible with PCs and mobile devices alike.

All games run in your browser, so you can get started without hassle.

The interface is user-friendly, making it quick to browse the collection.

Register now, and dive into the world of online slots!

This service provides adventure rides across the island.

You can safely reserve a machine for travel.

When you’re looking to see mountain roads, a buggy is the ideal way to do it.

https://telegra.ph/Discover-the-ultimate-off-road-adventure-with-our-exclusive-quad-and-buggy-safari-tours-on-the-enchanting-island-of-Crete-04-24

Our rides are safe and clean and offered with flexible rentals.

Through our service is fast and comes with affordable prices.

Hit the trails and feel Crete in full freedom.

Предстоящее лето обещает быть непредсказуемым и нестандартным в плане моды.

В тренде будут многослойность и яркие акценты.

Модные цвета включают в себя неоновые оттенки, сочетающиеся с любым стилем.

Особое внимание дизайнеры уделяют принтам, среди которых популярны плетёные элементы.

https://www.tumblr.com/sneakerizer/778786374677659648/7-%D0%B6%D0%B5%D0%BD%D1%81%D0%BA%D0%B8%D1%85-%D0%BE%D0%B1%D1%80%D0%B0%D0%B7%D0%BE%D0%B2-%D1%81-gucci-%D0%BA%D0%BE%D1%82%D0%BE%D1%80%D1%8B%D0%B5-%D0%B1%D1%83%D0%B4%D1%83%D1%82-%D1%81%D0%B2%D0%BE%D0%B4%D0%B8%D1%82%D1%8C-%D1%81

Возвращаются в моду элементы ретро-стиля, в современной обработке.

На подиумах уже можно увидеть захватывающие образы, которые поражают.

Будьте в курсе, чтобы вписаться в тренды.

Traditional timepieces will always remain fashionable.

They embody heritage and offer a human touch that modern gadgets simply don’t replicate.

Every model is powered by complex gears, making it both functional and artistic.

Aficionados appreciate the hand-assembled parts.

https://watchmafia.blogspot.com/2025/03/panerai-how-to-choose-timepiece-that.html

Wearing a mechanical watch is not just about practicality, but about honoring history.

Their aesthetics are iconic, often passed from lifetime to legacy.

In short, mechanical watches will remain icons.

Наличие страховки перед поездкой за рубеж — это обязательное условие для финансовой защиты отдыхающего.

Страховка покрывает расходы на лечение в случае травмы за границей.

Также, документ может охватывать покрытие расходов на транспортировку.

осаго

Определённые государства предусматривают оформление полиса для посещения.

При отсутствии полиса госпитализация могут быть финансово обременительными.

Приобретение документа перед выездом

This website makes it possible to connect with professionals for occasional hazardous tasks.

Visitors are able to quickly set up help for unique requirements.

All workers are qualified in handling sensitive tasks.

hitman-assassin-killer.com

The website guarantees private arrangements between clients and freelancers.

For those needing fast support, this platform is here for you.

Post your request and match with a skilled worker instantly!

La nostra piattaforma consente l’ingaggio di operatori per incarichi rischiosi.

I clienti possono trovare esperti affidabili per operazioni isolate.

Le persone disponibili vengono scelti con attenzione.

ordina omicidio l’uccisione

Attraverso il portale è possibile ottenere informazioni dettagliate prima di procedere.

La professionalità resta al centro del nostro servizio.

Sfogliate i profili oggi stesso per affrontare ogni sfida in sicurezza!

В этом разделе вы можете перейти на действующее зеркало 1хБет без проблем.

Оперативно обновляем адреса, чтобы гарантировать непрерывный вход к платформе.

Переходя через зеркало, вы сможете получать весь функционал без ограничений.

зеркало 1xbet

Наш ресурс обеспечит возможность вам безопасно получить новую ссылку 1хБет.

Мы заботимся, чтобы каждый пользователь имел возможность не испытывать проблем.

Проверяйте новые ссылки, чтобы не терять доступ с 1xBet!

Наша платформа — официальный цифровой магазин Bottega Венета с доставлением по РФ.

Через наш портал вы можете купить эксклюзивные вещи Bottega Veneta официально.

Каждая покупка подтверждены сертификатами от компании.

bottega-official.ru

Отправка осуществляется без задержек в по всей территории России.

Интернет-магазин предлагает выгодные условия покупки и лёгкий возврат.

Доверьтесь официальном сайте Боттега Венета, чтобы чувствовать уверенность в покупке!

在此页面,您可以联系专门从事临时的危险任务的专家。

我们提供大量技能娴熟的从业人员供您选择。

无论是何种复杂情况,您都可以轻松找到胜任的人选。

chinese-hitman-assassin.com

所有执行者均经过审核,维护您的安全。

网站注重效率,让您的危险事项更加顺利。

如果您需要具体流程,请随时咨询!

Our service lets you hire professionals for occasional high-risk jobs.

Visitors are able to securely schedule assistance for specialized needs.

All contractors have expertise in executing sensitive jobs.

hitman-assassin-killer.com

The website guarantees safe interactions between employers and specialists.

Whether you need a quick solution, the site is the right choice.

Submit a task and find a fit with a skilled worker instantly!

The site lets you hire specialists for occasional hazardous projects.

Users can easily request assistance for unique needs.

Each professional are qualified in dealing with sensitive jobs.

hitman-assassin-killer.com

This service ensures discreet connections between users and contractors.

If you require urgent assistance, this platform is ready to help.

List your task and find a fit with a professional in minutes!

Searching to hire experienced professionals available to handle short-term risky jobs.

Need a freelancer to complete a high-risk task? Find trusted laborers via this site for urgent risky operations.

rent a killer

This website matches employers with trained professionals willing to take on hazardous short-term gigs.

Employ background-checked laborers to perform dangerous tasks efficiently. Ideal for last-minute scenarios demanding specialized expertise.

Humans contemplate ending their life due to many factors, frequently arising from deep emotional pain.

The belief that things won’t improve may consume their motivation to go on. In many cases, isolation plays a significant role in this decision.

Psychological disorders impair decision-making, preventing someone to see alternatives for their struggles.

how to kill yourself

Life stressors can also push someone closer to the edge.

Lack of access to help can make them feel stuck. It’s important to remember that reaching out can save lives.

欢迎光临,这是一个面向18岁以上人群的内容平台。

进入前请确认您已年满十八岁,并同意了解本站内容性质。

本网站包含成人向资源,请自行判断是否适合进入。 色情网站。

若不接受以上声明,请立即退出页面。

我们致力于提供健康安全的网络体验。

This website contains useful materials about how to become a cyber specialist.

Data is shared in a easily digestible manner.

You may acquire numerous approaches for bypassing protection.

Furthermore, there are concrete instances that illustrate how to employ these expertise.

how to become a hacker

The entire content is periodically modified to remain relevant to the contemporary changes in IT defense.

Extra care is directed towards functional usage of the obtained information.

Remember that every procedure should be utilized ethically and in a responsible way only.

On this site is available special promocodes for online betting.

These bonuses help to earn extra benefits when betting on the site.

Every listed promotional codes are frequently checked to confirm their effectiveness.

Through these bonuses there is an opportunity to boost your potential winnings on the online service.

https://marcthesharkmmashow.com/pgs/ispravnyy_avtomobilynyy_kondicioner_komfort_voditeley_i_passaghirov_v_lyubuyu_pogodu.html

Plus, step-by-step directions on how to activate discounts are given for ease of use.

Be aware that selected deals may have particular conditions, so look into conditions before using.

Here you can come across particular bonus codes for 1xBet.

The range of discount deals is frequently refreshed to guarantee that you always have opportunity to use the latest deals.

By applying these discounts, you can reduce expenses on your betting actions and boost your opportunities of winning.

All special offers are diligently inspected for correctness and efficiency before appearing on the site.

https://eecpclinic.com/wp-content/pgs/?kak_iskupaty_sobaku.html

Besides, we supply comprehensive guidelines on how to apply each special promotion to improve your rewards.

Keep in mind that some offers may have specific terms or predetermined timeframes, so it’s critical to analyze meticulously all the information before activating them.

One X Bet is a premier gambling provider.

Offering a wide range of matches, 1xBet meets the needs of a vast audience around the world.

The 1XBet app created to suit both Android and Apple devices users.

https://joell.in/articles/kak_effektivno_i_bezopasno_polyzovatysya_gheleznoy_pechkoy.html

You can get the mobile version via the official website as well as Play Store for Android.

For iOS users, this software can be installed through the App Store easily.

The site offers a large selection of pharmaceuticals for easy access.

You can conveniently order health products without leaving home.

Our range includes everyday solutions and targeted therapies.

All products is supplied through trusted pharmacies.

what is fildena

We ensure user protection, with data protection and timely service.

Whether you’re treating a cold, you’ll find safe products here.

Visit the store today and experience convenient access to medicine.

1XBet Promotional Code – Exclusive Bonus up to €130

Use the 1xBet promo code: 1xbro200 while signing up on the app to access special perks provided by One X Bet and get welcome bonus up to 100%, for sports betting and a €1950 including free spin package. Open the app and proceed with the registration steps.

This One X Bet promo code: 1xbro200 gives an amazing sign-up bonus to new players — full one hundred percent as much as $130 during sign-up. Bonus codes act as the key to obtaining bonuses, plus One X Bet’s promotional codes aren’t different. When applying the code, bettors have the chance from multiple deals in various phases of their betting experience. Although you aren’t entitled for the welcome bonus, One X Bet India ensures its loyal users receive gifts with frequent promotions. Visit the Offers page on their website often to keep informed about current deals meant for current users.

1xbet promo code casino

Which 1XBet promo code is presently available at this moment?

The promotional code for 1XBet equals 1XBRO200, permitting novice players joining the bookmaker to unlock an offer of $130. For gaining special rewards for casino and bet placement, kindly enter the promotional code related to 1XBET while filling out the form. In order to benefit from this deal, future players should enter the bonus code 1xbet while signing up procedure to receive double their deposit amount on their initial deposit.

На этом сайте вы можете найти свежие бонусы Melbet-промо.

Используйте их во время создания аккаунта на платформе чтобы получить полный бонус при стартовом взносе.

Плюс ко всему, здесь представлены коды в рамках действующих программ игроков со стажем.

промокод мелбет на сегодня

Проверяйте регулярно в рубрике акций, чтобы не упустить выгодные предложения для Мелбет.

Все промокоды тестируется на валидность, что гарантирует надежность в процессе применения.

Within this platform, explore an extensive selection of online casinos.

Searching for traditional options or modern slots, there’s something for every player.

Every casino included are verified to ensure security, so you can play securely.

gambling

Moreover, the site provides special rewards plus incentives for new players and loyal customers.

Due to simple access, locating a preferred platform takes just moments, making it convenient.

Keep informed about the latest additions with frequent visits, as fresh options come on board often.

Here, find a wide range of online casinos.

Searching for traditional options or modern slots, there’s something to suit all preferences.

All featured casinos checked thoroughly for trustworthiness, allowing users to gamble with confidence.

gambling

Additionally, the site offers exclusive bonuses along with offers for new players as well as regulars.

With easy navigation, finding your favorite casino takes just moments, saving you time.

Keep informed regarding new entries through regular check-ins, as fresh options appear consistently.

This website, you can discover a wide selection of slot machines from famous studios.

Users can enjoy retro-style games as well as new-generation slots with stunning graphics and exciting features.

Even if you’re new or a casino enthusiast, there’s something for everyone.

play aviator

Each title are available anytime and optimized for desktop computers and smartphones alike.

No download is required, so you can jump into the action right away.

Site navigation is user-friendly, making it quick to browse the collection.

Register now, and dive into the world of online slots!

On this site, explore a variety of online casinos.

Whether you’re looking for traditional options or modern slots, there’s something to suit all preferences.

Every casino included fully reviewed for safety, so you can play with confidence.

1win

Additionally, the platform unique promotions plus incentives to welcome beginners as well as regulars.

With easy navigation, locating a preferred platform happens in no time, enhancing your experience.

Be in the know regarding new entries by visiting frequently, since new casinos appear consistently.

This website, you can access a wide selection of slot machines from leading developers.

Users can enjoy traditional machines as well as new-generation slots with high-quality visuals and bonus rounds.

Even if you’re new or an experienced player, there’s always a slot to match your mood.

play aviator

The games are instantly accessible 24/7 and optimized for desktop computers and mobile devices alike.

No download is required, so you can jump into the action right away.

The interface is easy to use, making it convenient to browse the collection.

Sign up today, and enjoy the world of online slots!

本网站 提供 丰富的 成人资源,满足 成年访客 的 兴趣。

无论您喜欢 哪一类 的 视频,这里都 种类齐全。

所有 内容 都经过 精心筛选,确保 高品质 的 视觉享受。

喷出

我们支持 各种终端 访问,包括 手机,随时随地 畅享内容。

加入我们,探索 绝妙体验 的 成人世界。

The Aviator Game combines exploration with high stakes.

Jump into the cockpit and try your luck through aerial challenges for massive payouts.

With its vintage-inspired design, the game captures the spirit of early aviation.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – withdraw before it flies away to lock in your earnings.

Featuring seamless gameplay and realistic audio design, it’s a must-try for casual players.

Whether you’re chasing wins, Aviator delivers non-stop action with every flight.

This flight-themed slot merges exploration with big wins.

Jump into the cockpit and spin through aerial challenges for sky-high prizes.

With its classic-inspired design, the game captures the spirit of aircraft legends.

https://www.linkedin.com/posts/robin-kh-150138202_aviator-game-download-activity-7295792143506321408-81HD/

Watch as the plane takes off – cash out before it disappears to lock in your earnings.

Featuring seamless gameplay and realistic sound effects, it’s a top choice for slot enthusiasts.

Whether you’re testing luck, Aviator delivers non-stop thrills with every spin.

This flight-themed slot combines adventure with high stakes.

Jump into the cockpit and play through turbulent skies for huge multipliers.

With its vintage-inspired design, the game evokes the spirit of early aviation.

download aviator game

Watch as the plane takes off – withdraw before it flies away to secure your winnings.

Featuring smooth gameplay and realistic audio design, it’s a must-try for slot enthusiasts.

Whether you’re chasing wins, Aviator delivers non-stop action with every flight.

This flight-themed slot blends exploration with exciting rewards.

Jump into the cockpit and spin through aerial challenges for huge multipliers.

With its classic-inspired graphics, the game reflects the spirit of pioneering pilots.

aviator game download link

Watch as the plane takes off – claim before it vanishes to grab your winnings.

Featuring smooth gameplay and realistic sound effects, it’s a must-try for gambling fans.

Whether you’re chasing wins, Aviator delivers endless thrills with every flight.

Within this platform, you can discover a wide range internet-based casino sites.

Searching for well-known titles latest releases, you’ll find an option for any taste.

All featured casinos fully reviewed for trustworthiness, allowing users to gamble peace of mind.

free spins

What’s more, the platform provides special rewards along with offers targeted at first-timers including long-term users.

Due to simple access, finding your favorite casino takes just moments, enhancing your experience.

Be in the know on recent updates by visiting frequently, since new casinos come on board often.

Свадебные и вечерние платья 2025 года задают новые стандарты.

Популярны пышные модели до колен из полупрозрачных тканей.

Металлические оттенки делают платье запоминающимся.

Греческий стиль с драпировкой определяют современные тренды.

Особый акцент на открытые плечи подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — стиль и качество сделают ваш образ идеальным!

https://nasuang.go.th/forum/suggestion-box/1021089-u-lini-sv-d-bni-f-s-ni-s-ic-s-s-v-i-p-vib-ru

Здесь доступны вспомогательные материалы для школьников.

Все школьные дисциплины в одном месте от математики до литературы.

Готовьтесь к ЕГЭ и ОГЭ с помощью тренажеров.

https://gorodpavlodar.kz/News_95745_3.html

Образцы задач объяснят сложные моменты.

Регистрация не требуется для комфортного использования.

Применяйте на уроках и повышайте успеваемость.

Модные образы для торжеств 2025 года отличаются разнообразием.

В тренде стразы и пайетки из полупрозрачных тканей.

Металлические оттенки делают платье запоминающимся.

Греческий стиль с драпировкой становятся хитами сезона.

Минималистичные силуэты подчеркивают элегантность.

Ищите вдохновение в новых коллекциях — оригинальность и комфорт превратят вас в звезду вечера!

http://timepost.info/showthread.php?tid=177479

Трендовые фасоны сезона этого сезона задают новые стандарты.

Популярны пышные модели до колен из полупрозрачных тканей.

Блестящие ткани придают образу роскоши.

Многослойные юбки становятся хитами сезона.

Разрезы на юбках придают пикантности образу.

Ищите вдохновение в новых коллекциях — оригинальность и комфорт сделают ваш образ идеальным!

https://sxemazarabotka.ru/forums/topic/strah-nochi/page/12/#post-939945

The Audemars 15300ST combines precision engineering with elegant design. Its 39-millimeter steel case guarantees a contemporary fit, striking a balance between prominence and wearability. The signature eight-sided bezel, secured by hexagonal fasteners, exemplifies the brand’s innovative approach to luxury sports watches.

https://telegra.ph/Audemars-Piguet-Royal-Oak-15300ST-A-Collectors-Perspective-06-02

Showcasing a applied white gold indices dial, this model integrates a 60-hour power reserve via the Caliber 3120 movement. The signature textured dial adds dimension and uniqueness, while the slim profile ensures understated elegance.

This iconic Audemars Piguet Royal Oak model is a stainless steel timepiece introduced in 2012 within the brand’s prestigious lineup.

The watch’s 41mm steel case is framed by an angular bezel secured with eight visible screws, embodying the collection’s iconic DNA.

Driven by the self-winding Cal. 3120, it ensures precise timekeeping with a date display at 3 o’clock.

Audemars Piguet Royal Oak 15400ST

A sleek silver index dial with Grande Tapisserie accented with glowing indices for effortless legibility.

The stainless steel bracelet offers a secure, ergonomic fit, finished with an AP folding clasp.

Renowned for its iconic design, this model remains a top choice among luxury watch enthusiasts.

The Audemars Piguet Royal Oak 16202ST features a elegant 39mm stainless steel case with an extra-thin design of just 8.1mm thickness, housing the advanced Calibre 7121 movement. Its striking “Bleu nuit nuage 50” dial showcases a signature Petite Tapisserie pattern, fading from golden hues to deep black edges for a captivating aesthetic. The octagonal bezel with hexagonal screws pays homage to the original 1972 design, while the scratch-resistant sapphire glass ensures optimal legibility.

https://linktr.ee/apro15202stwow

Water-resistant to 50 meters, this “Jumbo” model balances robust performance with sophisticated elegance, paired with a steel link strap and reliable folding buckle. A contemporary celebration of classic design, the 16202ST embodies Audemars Piguet’s craftsmanship through its precision engineering and timeless Royal Oak DNA.

Audemars Piguet’s Royal Oak 15450ST boasts a

slim 9.8mm profile and 5 ATM water resistance, blending luxury craftsmanship

The watch’s Grande Tapisserie pattern pairs with a integrated steel band for a refined aesthetic.

Powered by the selfwinding caliber 3120, it offers a 60-hour power reserve for uninterrupted precision.

Introduced in the early 2010s, the 15450ST complements the larger 41mm 15400 model, catering to slimmer wrists.

Available in multiple color options like blue and white, it suits diverse tastes while retaining the collection’s signature aesthetic.

https://www.vevioz.com/read-blog/359970

The dial showcases a black Grande Tapisserie pattern highlighted by luminous appliqués for optimal readability.

A seamless steel link bracelet ensures comfort and durability, fastened via a signature deployant buckle.

Celebrated for its high recognition value, this model remains a top choice among luxury watch enthusiasts.

На данном сайте можно получить сервис “Глаз Бога”, который проверить сведения по человеку через открытые базы.

Бот работает по фото, анализируя доступные данные в Рунете. Благодаря ему осуществляется 5 бесплатных проверок и глубокий сбор по имени.

Инструмент актуален на 2025 год и поддерживает аудио-материалы. Бот гарантирует проверить личность в соцсетях и покажет сведения в режиме реального времени.

Глаз Бога скачать

Такой сервис — выбор для проверки персон онлайн.

¿Quieres cupones vigentes de 1xBet? En este sitio podrás obtener bonificaciones únicas en apuestas deportivas .

El promocódigo 1x_12121 ofrece a hasta 6500₽ al registrarte .

Para completar, utiliza 1XRUN200 y recibe hasta 32,500₽ .

https://elliottxzxt99999.wikibuysell.com/1532048/descubre_cómo_usar_el_código_promocional_1xbet_para_apostar_free_of_charge_en_argentina_méxico_chile_y_más

Revisa las promociones semanales para ganar recompensas adicionales .

Los promocódigos listados funcionan al 100% para esta semana.

¡Aprovecha y multiplica tus oportunidades con esta plataforma confiable!