WGC analysis shows that adding between 7% and 18% in gold to an average Indian institutional portfolio over the last decade would have resulted in higher risk-adjusted returns. As per our analysis too, putting 15% of portfolio investment in Gold gives a boost to your portfolio in the long term.

Globally, gold demand can be categorised into four: Jewellery demand (55%), Investment demand (25%), Technology demand (8%) and demand by Central banks (12%). But the trend in India is different, where only numbers for Jewellery demand (75%) and Investment demand (25%) are published by World Gold Council.

In India, Investment Demand constitutes Bar & Coin, Central Bank buying, Digital Form of Gold (ETF, Sovereign Gold Bond, Digi Gold, etc). Indians love to buy gold in the form of Jewellery to showcase their wealthy status, so Jewellery Demand is more. But as Gold Jewellery has the limitation of safety, purity and storage, Indians are investing more in the digital form of Gold.

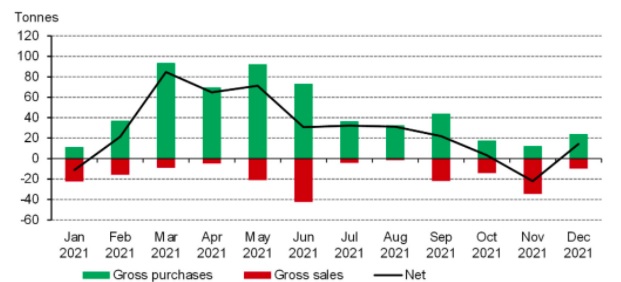

Looking at a global perspective, Gold Investment demand was dull, as there were net outflows of 170 tonnes in Gold ETF in 2021. But this was compensated by Central bank buying. The broad range of buying in 2021 has shown there is still a significant appetite for gold as a reserve asset. While demand from central banks can, at times, be less predictable than other sources of gold demand – given it is often policy rather than market-driven – we remain confident that the overall trend of net buying will continue into 2022.

Global Central Bank buying in 2021

Source: World Gold Council

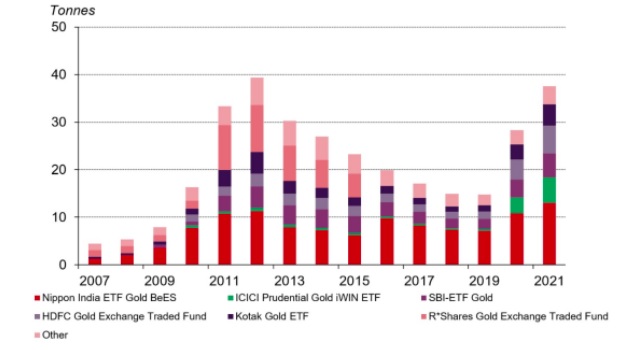

Meanwhile, Indian investors continued to pile into Indian gold ETFs, driven by a lower price point, concerns over higher equity valuations and safe-haven demand. Net inflows increased by 9.3t, taking gold holdings to 37.6t by the end of 2021

Holdings of Indian gold ETFs on Indian exchanges

Source: World Gold Council

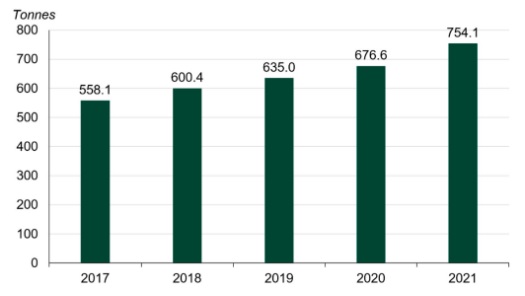

After adding 41.6t in 2020, the Indian Central bank – RBI ramped up its gold purchases in 2021, buying an additional 77.5t and taking its total gold reserves to 754.1 by the end of the year

RBI Gold reserves at the end of the year

Source: World Gold Council

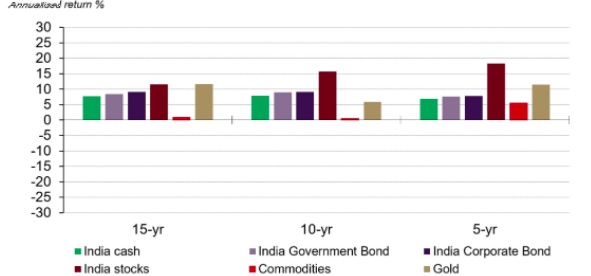

Returns are a crucial factor for any asset class. Looking at the last fifteen years, gold in rupees has delivered an annualised rate of return of 11.7%, marginally higher than equities (11.6%) and higher than returns on other asset classes such as bonds (government and corporate) and cash. Over the last five years, gold has underperformed equities but outperformed other asset classes such as bonds and cash

Annualised returns for various time periods as on 2021

Source: World Gold Council

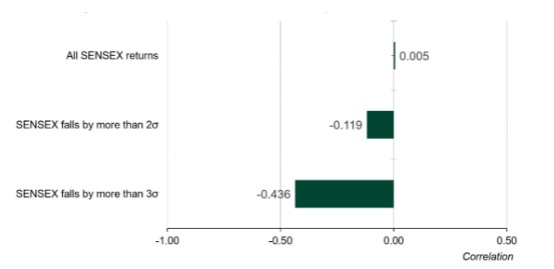

Gold benefits from flight-to-quality inflows during periods of heightened risk. The greater a downturn in stocks and other risk assets the more negative gold’s correlation to these assets become. But gold’s correlation not only works for investors in times of turmoil. Due to its dual nature as both jewellery and investment, gold’s long-term price trend is supported by income growth. When stocks rally their correlation to gold can increase, driven by the wealth effect and, sometimes, by higher inflation expectations

Correlation between gold and SENSEX in the various environment of stocks’ performance

Source: World Gold Council

* Correlations computed using weekly returns of the BSE Sensex and LBMA Gold Price PM Fix (in Indian rupees) between January 1984 and December 2021

This combination of returns and diversifier properties means that adding gold can enhance the risk-adjusted returns of a pension fund portfolio. Indian investors with an asset allocation equivalent to that of an average institutional investor portfolio would have benefitted from including gold. WGC analysis shows that adding between 7% and 18% in gold to an average Indian institutional portfolio over the last decade would have resulted in higher risk-adjusted returns. As per our analysis too, putting 15% of portfolio investment in Gold gives a boost to your portfolio in the long term.

There are various ways in investing in Gold through Augmont, which one can choose from:

- Digital Gold

- Gold SIP

- Gold Bars and Coins

- Gold Jewellery

- Gold on EMI

- Gold ETF

- Sovereign Gold Bond