People are looking forward to the auspicious occasions of Dhanteras and Diwali to invest in Gold and Silver as the festive season approaches this year. People buy gold as a symbol of luck, wealth, abundance, and auspiciousness during Dhanteras, which is one of the annual peaks in precious metal sales. The day is considered fortunate for purchasing gold, silver, and kitchenware because it represents wealth and prosperity.

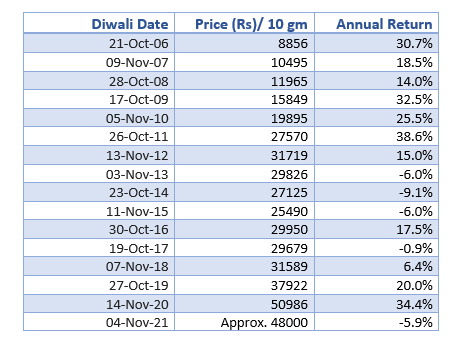

Meanwhile, Gold has been a good store of value, hedge against uncertain times and inflation in long term. Gold has delivered more than 13% CAGR returns in the last 15 years if invested during the Diwali period.

Diwali to Diwali returns on Gold

Gold fundamentals from a global macro perspective:

- From Diwali 2019 to Diwali 2020, Gold prices rose 34% as a Fear Hedge, as there was lots of uncertainty, Low Growth, Ample Liquidity and Monetary easing in the market

- From Diwali 2020 to Diwali 2021, there has been Reflation Trade in Gold and it has fallen 6% by trading one step up and two step down throughout the year. Inflation has been at a multidecade high, Liquidity continues, and Growth has recovered due to the low base effect.

- Inflation has never been this high with US monetary policy this lax — and it’s only getting worse, as gold’s technical compression continues. Inflation in the United Kingdom is at a nine-year high, while inflation in the United States and the Eurozone is at a 13-year high, and Energy prices are at a 13-year high. Inflationary signs are becoming more visible by the day, ranging from rising transportation costs, rising energy bills, rising food and general commodity prices, to product and labor shortages.

- Large national debts incurred during the COVID-19 pandemic must now be repaid, and any government’s strategy will include devaluing its currency through inflation. The economic situation is dire, and national economies are in bad health, yet the investment community does not appear to be aware of this.

Outlook till Diwali 2022

- The inflation issue isn’t going away anytime soon, and we’re now on the verge of entering an era of inflation, in which paper currencies continue to lose value and economic conditions worsen. As the situation worsens, investors’ anxieties will certainly lead them to gold to secure their fortunes.

- We are likely to see Stagflation till next year and monetary liquidity in the market would be turned off by Tapering. High inflation will prevail, economic growth would be slower and there would be diverging monetary policies in Emerging and Developed Markets.

- With many weddings being organized post-Diwali, gold sales are reviving in a big way due to pent-up demand and an overall festive mood. As Gold prices are 6% lower than last Diwali and with most of the COVID restrictions being lifted off this year, gold buyers are returning to the market.

- If the Equity market and Cryptocurrencies, which are very overbought, see a correction, we will likely see a boost in global ETF demand for Gold which in turn might take prices to record highs

- Although the market has priced in an interest rate hike for December of next year, new CPI data and hawkish minutes from the US Fed indicate that the Fed is now considering an interest rate hike sooner in 2022. Interest rate hikes may function as a short-term damper on gold demand, but any increase will most likely be tiny and negligible in comparison to the high levels of inflation we are expected to face.

Given the current economic challenges, investors are likely to be more cautious in the short term, and cautious investors hedge and diversify, with gold being a key part of any hedging or diversification strategy.

Gold prices have been trading in a symmetrical triangle for the last three years. A sustainable closing above $1830/ Rs 48500 would give a bullish breakout for prices to trade higher towards $2000/Rs 55000 in the coming months with strong support at $1700/Rs 45000.

Gold right now is a strategic investment – because we don’t know what is going to happen to the world in one or two years. So, to hedge yourself against this uncertainty, you should at least have 15-20% Gold in your portfolio. What’s a better way to invest in Gold through Augmont Digi Gold or Gold SIP where you can buy Gold with 99.9% purity, 24*7, with at most security and storage.

Read more: Best Way to Buy Gold Online