Gold and Silver – Kya Lagta Hai

Short-term View (up to 1 week) – Retracement – As Gold and Silver see retracement, next support is 52000 and 65000 respectively.

Long-term View (3-4months) -Positive – Any dips towards 50000-51000 and 65000-66000 should be used as buying opportunity for target of 55000 and 75000 for Gold and Silver respectively

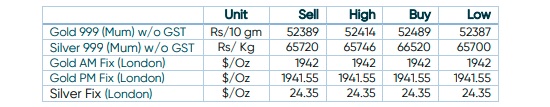

SPOT Prices

SPOT Gold Daily Price Chart

SPOT Silver Daily Price Chart

Important News and Triggers

- International News – – The yen’s swift collapse to a two-decade low, plus a resilient showing from gold, have combined to lift bullion priced in the Japanese currency to an all-time high. The traditional haven now costs almost quarter-of-a-million yen an ounce, up 18% this year.

- Demand & Supply – Global Gold ETF demand is very strong adding 12 tonnes last week with current holdings of 3329 tonnes now.

- Economic Data – Federal Reserve Chairman Jerome Powell said Thursday that a 50 basis-point rate hike was on the table for the May meeting as the central bank aims to step up the pace of monetary policy tightening to curb elevated inflation.

- Domestic News– Retail demand remained sluggish during March as buyers postponed purchases in anticipation of a correction in the gold price.

Disclaimer