By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

Before the start of 2024, we released a report “Gold and Silver expected to rise 10% and 20% respectively in 2024” wherein a gold target of $2300 (~Rs 70,000) was specified. With economic uncertainty, gold prices have reached that target in three months.

This reflects a trend towards safer investments while navigating global economic tensions. As specified earlier, 2024 is going to be a golden year for gold. Now the question is if there is more steam left in this rally or if the prices will come down?

Let’s discuss the top five reasons that have kept gold to stay elevated in 2024:

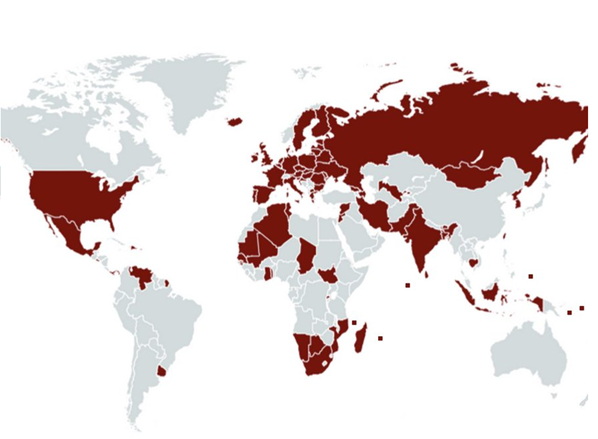

- Geopolitical Risk

Geopolitical risks are an important factor that supports Gold as there is no end seen yet with the Russian invasion of Ukraine, the Israel/Iran conflicts, or Houthi’s Red Sea attacks. Due to its scarcity, lack of liability, and credit risk, gold is a very liquid asset that has generally maintained its value throughout time. So safe-haven demand due to geopolitical tensions continues to support prices.

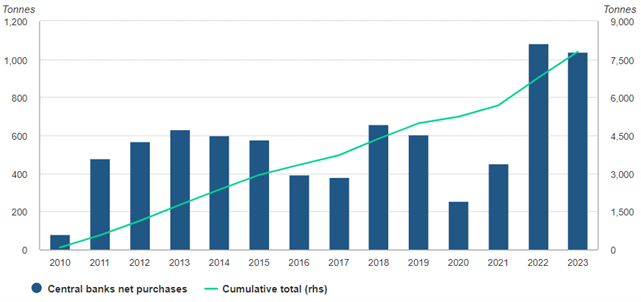

- Central Bank buying

The fact that central banks throughout the world are still accumulating physical gold is a major element in the recent spike in gold prices. The increased demand that results from these institutions building up their reserves directly affects price, pushing the price of precious metal to levels that were never before seen. Additionally, reserve managers in emerging markets tend to increase their gold holdings when there is a risk of financial sanctions. Central Banks around the world have bought more than 1000 tonnes of gold in the last two years and are expected to buy a similar amount in 2024.

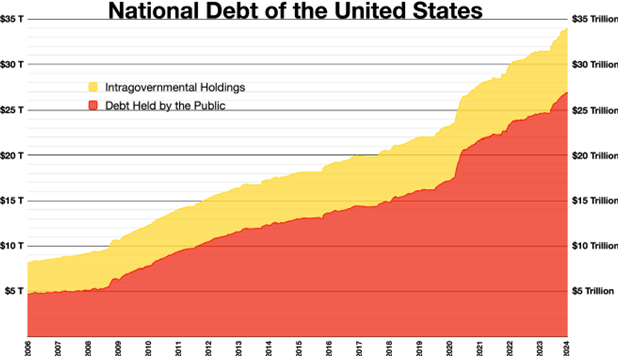

- Soaring Fiscal Debt

There is an urgent need for fiscal management because the U.S. debt has surpassed $34 trillion and interest payments are expected to exceed $870 billion by 2024. Debt is increasing more quickly than the economy, and as a result, the United States appears to be on the verge of a financial crisis. Furthermore, the Fed is given new authority and responsibilities virtually every year. The Federal Reserve, in my opinion, is already a way too strong organization that is not accountable to anyone. That contributes to the issue. The Fed’s capacity to influence national and even international economies has made it the most powerful entity in the world. Since Fitch and Moody’s downgraded U.S. debt twice last year—in August and November—a third downgrading would cause more investors to switch from the dollar to other currencies or gold as a crisis hedge.

- Elections Bonanza

Globally, more voters than ever in history will go to the polls as at least 64 countries representing a combined population of about 49% of the people in the world. Elections are sources of potential short-term volatility in financial markets.

However, the US Election is going to impact precious metals more than any other country in 2024. Gold rose by an average of 9.4% in the five elections since 2004. Each of these elections, particularly the most recent one between Trump and Biden, was fiercely contested. This year’s rematch is scheduled, and it will undoubtedly be much more contentious since, in addition to being older (78 and 82 years old, respectively, on Inauguration Day), both candidates are facing unprecedented levels of political and judicial scrutiny. So a lot of short-term volatility is going to be created in the second half of 2024 on election concerns.

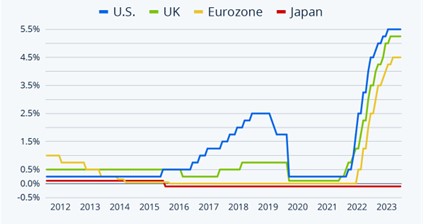

- Global monetary Easing ahead

The precious metal continues to be supported by the expectation of global central bank easing ahead. Swiss National Bank has already started rate cutting earlier this month. In the spring, most likely in June, the ECB is generally anticipated to follow. The rate cut cycle will begin regardless of whether the Fed makes two or three cuts this year. The FedWatch probability indicator from the CME adds to the optimistic feeling by indicating that there is a 60% chance that the Federal Reserve will lower interest rates in June. Since the US dollar is usually weaker against other currencies, investors holding other currencies may purchase gold at a lower cost.

What next?

Gold has gained positive momentum despite a strong Dollar Index and strong US Bond Yields, so one needs to be very cautious in this bull rally. Above mentioned factors will continue to support gold prices from falling below $2050 (~Rs 65000) in 2024. But as prices have run up very fast and oscillators are in the overbought zone, we are likely to see price retracement anytime. But dips should be used as a buying opportunity. The next target or resistance for the price is $2350 (~Rs 71000) and $2400 (~Rs 73000), while strong support is around $2250 (~Rs 68000) and $2200 (~ Rs 66500).

For a better risk-adjusted return portfolio, it is always advised to allocate at least 15-20% of the portfolio amount into Gold and Silver divided equally. The best way to start or stay invested in gold systematically is through Augmont Digital Gold SIP for better returns.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice