By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

2024 promises to be one of the most significant years in economic, political, and financial history. Elections will also be held in Taiwan, India, Europe, the United Kingdom, and the United States in 2024.

The longest and steepest yield curve inversion in 43 years continues to indicate a deep recession in the United States, while the eurozone is trapped in stagflation.

We do not, however, go long or short on a country’s or region’s GDP. This is why, recession or no recession, what counts is how stocks, bonds, commodities, and real assets react to future macro- and microeconomic developments. We should choose the best asset pairings to provide the best risk-adjusted returns.

Over time, a well-planned and suitably diversified portfolio remains a reliable financial planning tool. Ultimately, the key to a successful investing portfolio is to diversify your assets. Adding gold to your portfolio is one way to do so, as it can help offset some of the risk from other assets.

It is frequently difficult to foresee which asset class will perform well or poorly over the next five years, therefore diversifying between asset classes with low correlation – which do not always move together – provides us with a better return.

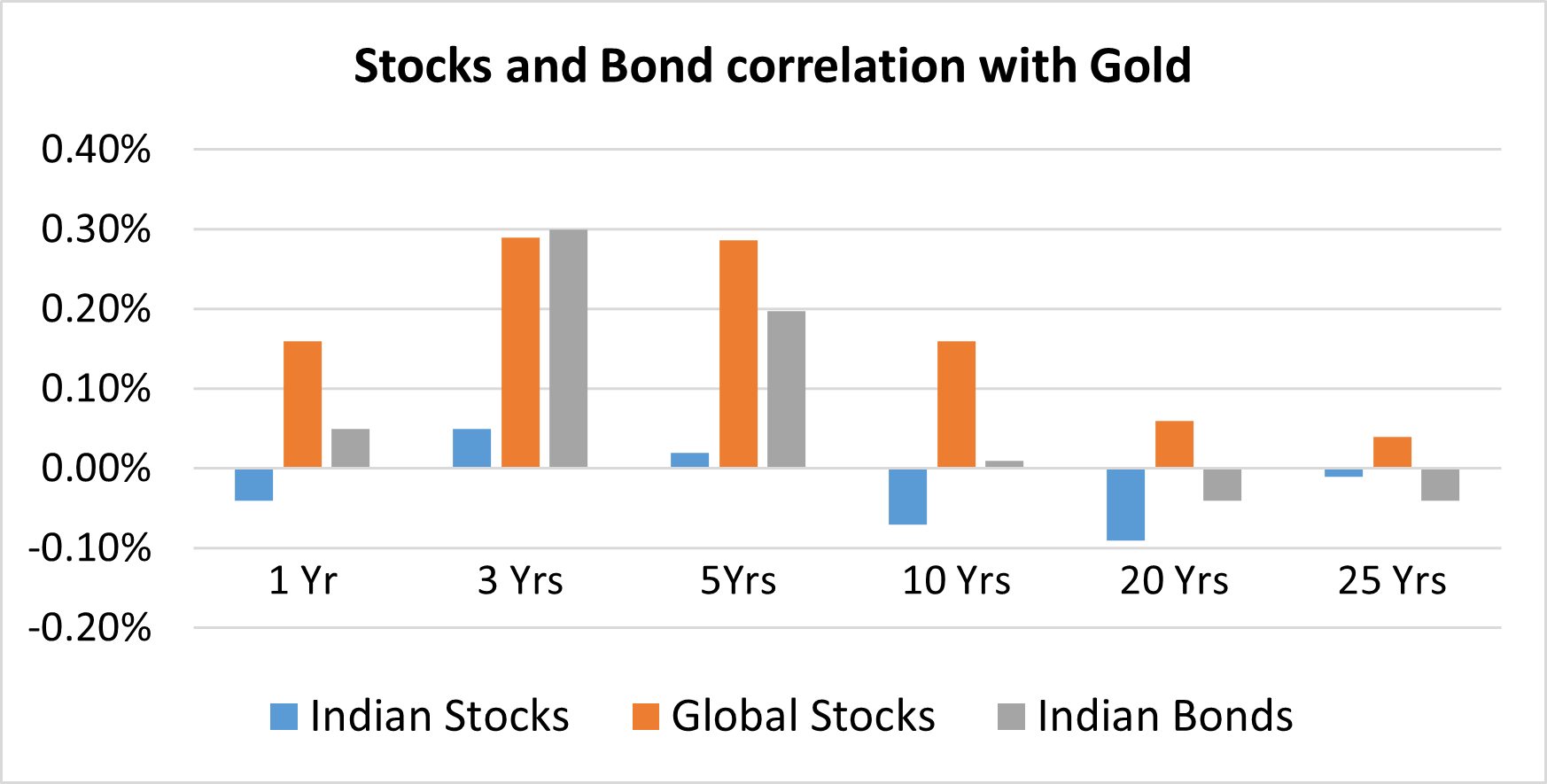

Gold generally has a very minimal correlation with Stocks and Bonds –

- When stocks do well – gold may not (2013 to 2016)

- When stocks don’t do well – bonds may do well (2000 to 2003)

- When gold did well & stocks didn’t (2008 to 2013)

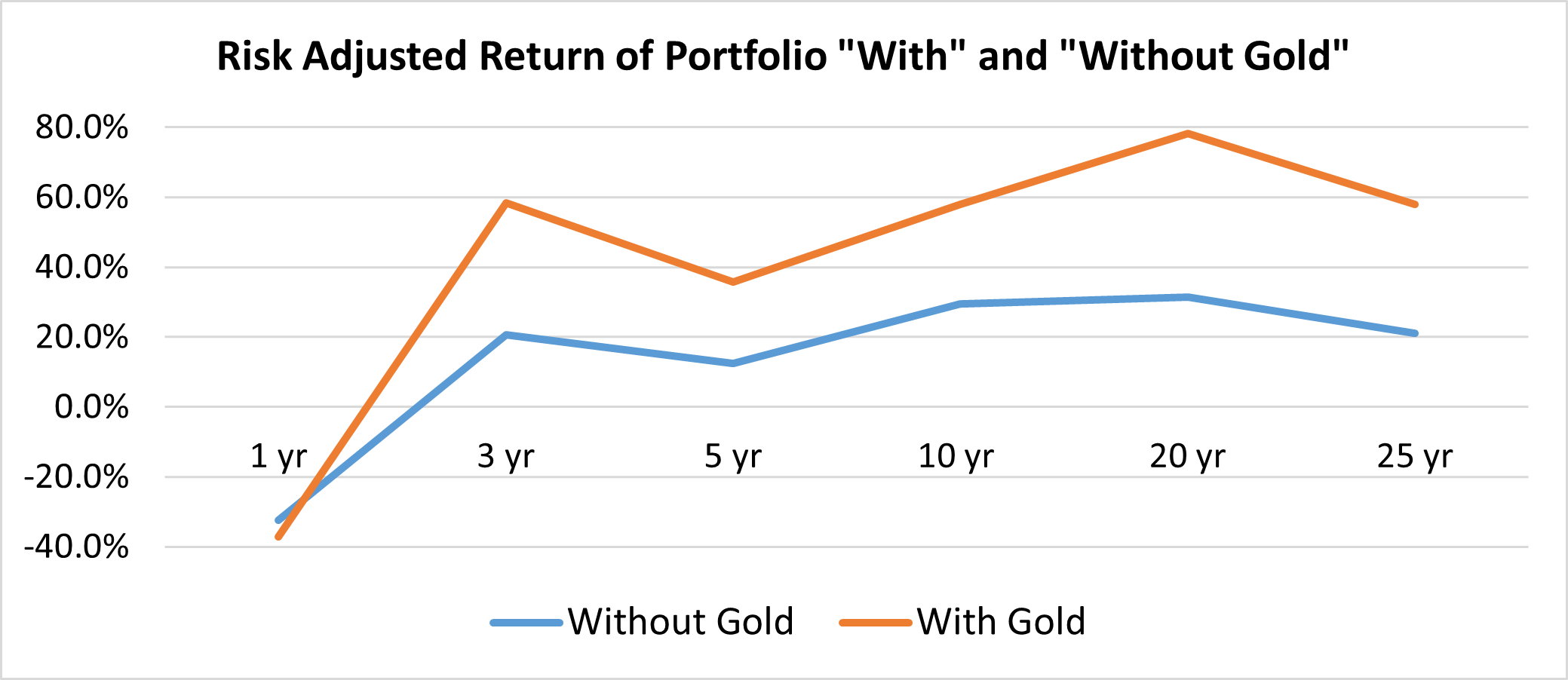

This chart shows the performance of the portfolio with and without gold. It could be differentiated, that a Portfolio with Gold gives a higher return than a portfolio without gold in each of the time frames whether short-term or long-term.

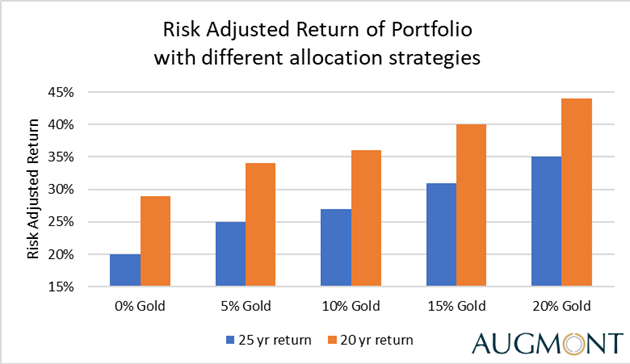

Now we know that a portfolio with Gold gives a higher return, but how much allocation is ideal? So in the last 20 yrs and 25 yrs timeframe suggests, a portfolio with 20% gold allocation gives the highest return.

The best way to start or stay invested in gold and silver is through Augmont Digital Gold and Augmont Digital Silver for better returns. Those who have missed this 2023 rally, can still take advantage as Gold and Silver prices are expected to rise 10% and 20% respectively in 2024.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice