Commodities, with a few exceptions, have rallied strongly since President Putin ordered the attack on Ukraine, thereby triggering a change in the market from worrying about tight supply to actually seeing supply disappear. Against this backdrop, traditional risk-off asset classes continue to shine with gold, the Swiss Franc, and the Japanese Yen in constant demand.

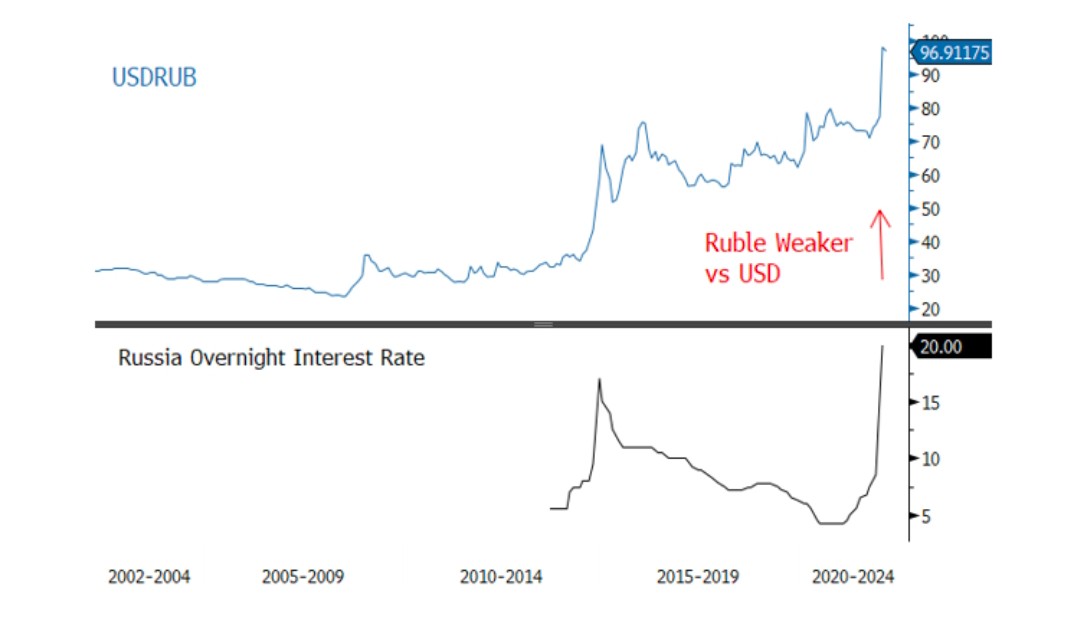

Higher yields, worsening inflation, a hawkish Fed, and the Russia-Ukraine conflict resulted in the precious metals complex rebounding strongly in February as other markets faltered. After consolidating in a year and a half long bullish flag pattern, gold bullion broke out of its trade range sparked by the Russia-Ukraine conflict. YTD 2022, the Russian Ruble has fallen more than 31% in value, and overnight interest rates are now 20%.

Russian Rubble in Free Fall and Overnight Interest Rates Soaring (2002-2022)

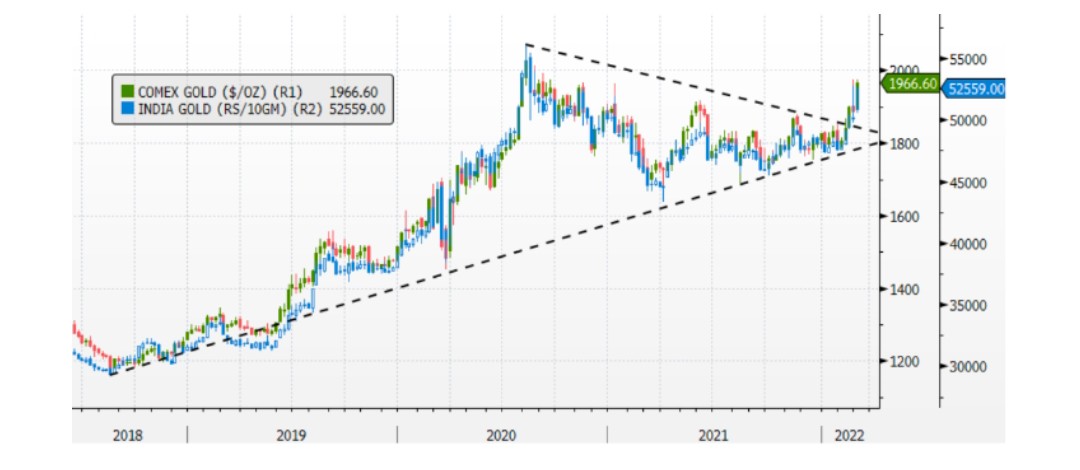

Investors have sought out bullion amid the uncertainty, with holdings in exchange-traded funds backed by the metal climbing to the highest since March and hedge fund managers boosting their net bullish gold bets to a 19-month high. Gold is up 4.36% YTD through February 28, 2022, and silver has increased 4.90%. The turnaround in gold since the end of January has created a strong trend on the daily chart and this constant move higher is likely to continue.

Weekly Gold Chart

Gold normally reacts negatively in a rate hiking environment but these rate increases have been priced into the precious metal’s outlook already, with risk-aversion currently seen as more important than a tighter monetary policy environment by the market. With risk continuing to provide a strong tailwind, gold may look to re-test last week spike-high at $1974/oz. shortly. Above here, $2000/oz. and the August 18, 2020 high of $2065/oz. come back into play.

You may also like to read: Higher Inflation, Geopolitical Tension sparks the Gold rally