By Dr. Renisha Chainani, Head Research, Augmont – Gold for All

It was FED interest rate decision week. At the start of March month, the highest probability was that FED will raise rates by 50 bps. But as the banking crisis broke out, bets were reduced to a 25bps rate hike. Finally, FED raised the interest rate by 25 bps and maintained its preference for extremely limited further rate hikes. Federal Reserve Powell also said “no” to rate cuts in 2023, citing the ongoing battle against stubborn inflation, which will continue until US inflation returns to desired levels. As a result, the time has come for the Federal Reserve to maintain these higher rates for an extended period of time as the banking crisis has broke out.

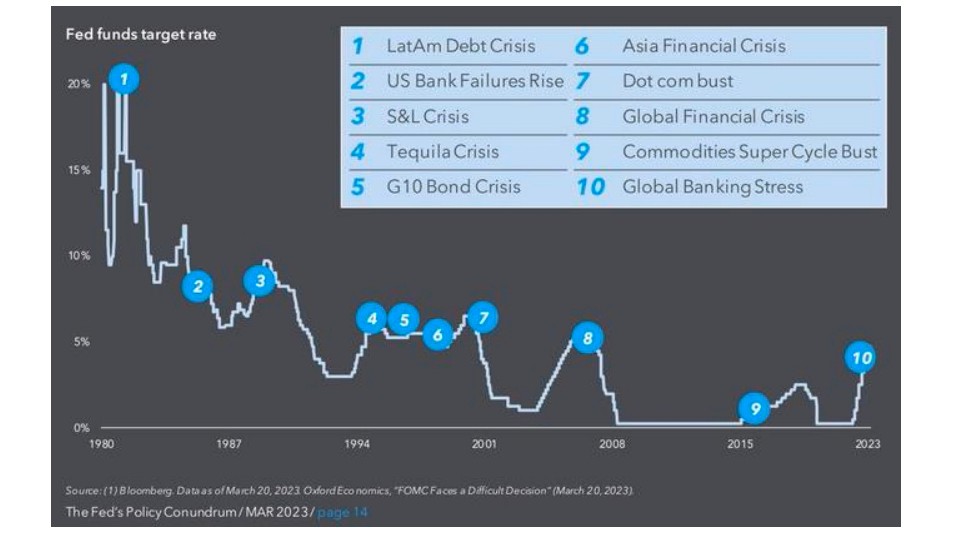

As FED has sharply raised interest rates by 425 bps in 2022 and 50 bps in 2023 to date, we are witnessing a banking crisis in the financial system. It is noticed that, whenever FED has started monetary tightening by raising Interest rates, it is followed by a burst or crisis in our financial system. And when such a crisis breaks out in the headlines, then only FED stops raising rates. This is evident from the chart below which shows that every FED tightening cycle of the last 40 years has claimed a large financial casualty.

Casualties of FED Tightening

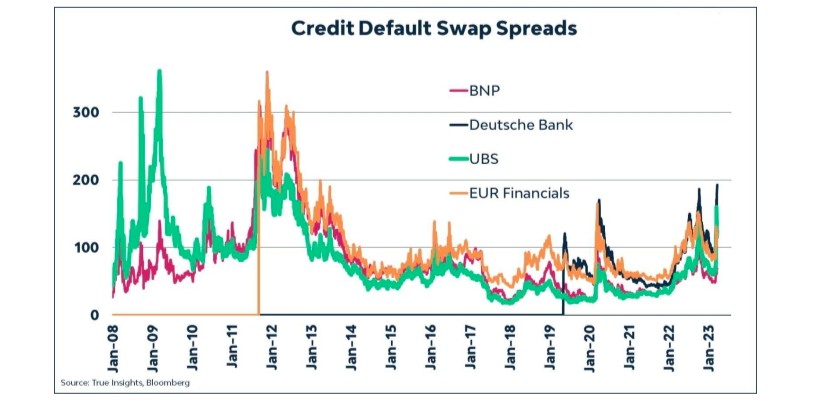

One more thing that was on the headlines this week was rising of Credit Default Swaps (CDS). CDS on various large U.S. banks have been creeping up lately. CDS is a type of insurance against default risk by a particular entity. After Silicon Valley Bank, Signature Bank, and Credit Suisse, now Deutsche bank is in trouble as its 5-year CDS spread has been exploding. The chart below depicts the CDS spread of major US banks, which has exploded in the last 15 days. The rising CDS spread depicts that uncertainty in the market is continuously rising.

CDS Spreads of major US Banks

As all the asset classes are interlinked to each other, the banking crisis contagion is creating a ripple effect on the bond market, equity market, currency market and commodity markets. Bond yields, Dollar Index and Equity Market have started falling on this uncertainty, while Gold has emerged as the best safe-heaven hedge during this banking turmoil.

Gold prices crossed a very important psychological level of $2000 in international markets and Rs 60000/10 gm in domestic markets this week. On 21st Dec 2022, we advised buying gold around $1820 (~Rs55000/10 gm) in the report titled “Inverse Head and Shoulder pattern target Rs 60000 for Gold in 2023” for the target of Rs $2020 (Rs 60000/ 10 gm) in 2023. This target is achieved this week as Gold prices hit a high of Rs 60450 in the domestic market amid the banking crisis. Silver, which was an underperformer, has also spiked, with prices crossing Rs 70000/kg psychological mark

Next week, Gold and Silver’s prices are expected to continue their bull run, as the banking crisis has just begun and it seems, this uncertainty will continue. Moreover, recession fears are rising in the US as Leading Economic Index is continuously dropping. Since 1965, the Leading Economic Index has successfully predicted every eight Recession when it falls below 0%, now it is -5%, so recession is evident in 2023.

The next target for Gold is $2070 (it’s previous high) in international markets and Rs 62000/10 gm in domestic markets. While Silver prices are expected to touch $25 in international markets and Rs 73000 (previous high) in domestic markets in the next few weeks. Buy on every dip should be a strategy used in the short-term and long-term.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advice. The author, Directors, and other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is in no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purposes and are not to be construed as investment advice.

3 Comments. Leave new

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.