By Dr. Renisha Chainani, Head-Research, Augmont – Gold for All.

Gold is often used as a hedging instrument. Gold’s status as a hedge means that it can help investors compensate for big losses. In simple terms, hedging is used to mitigate the risk of a loss on an investment or asset depreciation. Economic instability is unlikely to prompt investors to turn to gold as a hedge against the risks of inflation becoming too high. Gold is considered not only a commodity but also a financial asset. Gold is a store of wealth, which signifies safe storage, in addition to being a hedge.

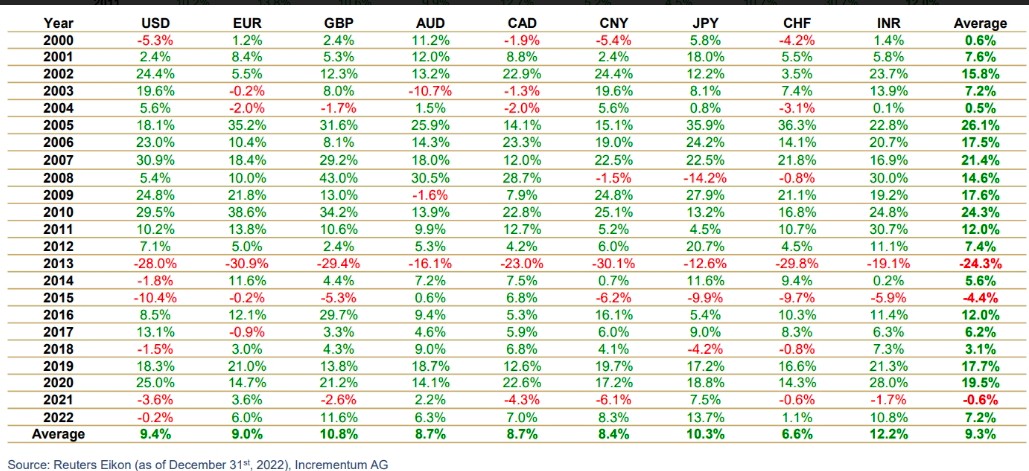

If we look at Gold’s performance over the last 20-25 years in various currencies, Gold has given the highest average return in Indian Rupee(INR) terms of more than 12%. This is a fantastic return in comparison to other asset classes, which have yielded a lesser return.

Gold performance in different currencies

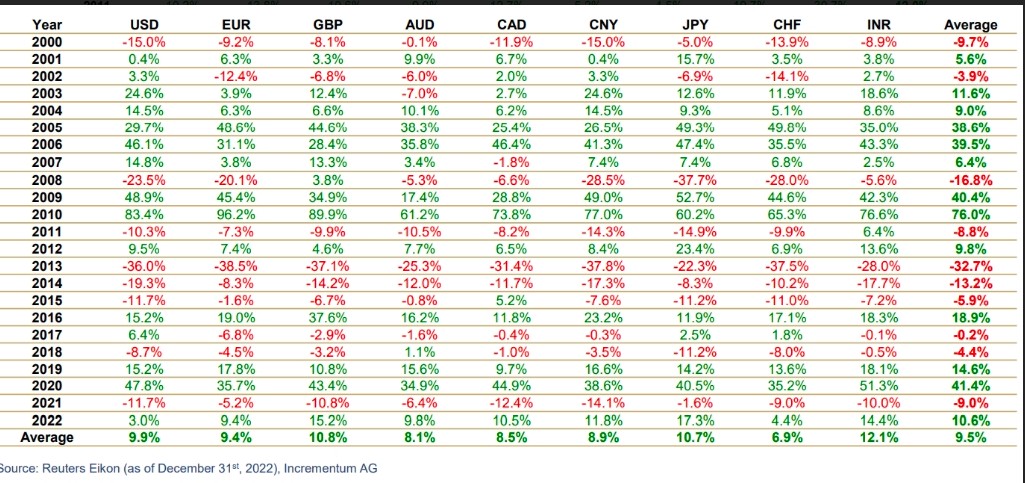

If we talk about another precious metal Silver, which is also used in the manufacturing of automobiles, solar panels, jewellery and electronics, it has also given more than 12% in the last 20-25 years in Indian Rupee(INR) terms.

Silver performance in different currencies

A deteriorating economic outlook will add to the safe-haven demand for Gold and Silver in 2023. Geopolitical risks are also likely to remain elevated, encouraging investors to hedge in Gold and Silver. It is always advised to put 15-20% of the portfolio in Gold and Silver for portfolio diversification as Indian precious metal prices are again ready for double-digit return in 2023 by trading at more than Rs 60000/gm and Rs 80000/kg in 2023 as recommended in “Inverse Head and Shoulder pattern target Rs 60000 for Gold in 2023“ and in “25% upside expected in Silver in 2023“ weekly blog.

2 Comments. Leave new

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Your article helped me a lot, is there any more related content? Thanks!