By Dr. Renisha Chainani, Head Research, Augmont – Gold for All

What is Money Supply (M2)?

The U.S. Money Supply M2 is a monetary aggregate that includes cash, checking deposits, savings deposits, money market securities, and other time deposits that are less than $100,000. It is one of the most commonly used measures of the money supply in the United States. The M2 money supply in the United States was approximately $21.7 trillion in July 2022 and now has contracted to $20.8 trillion by March 2023.

Changes in the money supply can have an impact on the economy, as an increase in the money supply can lead to higher levels of inflation, while a decrease in the money supply can lead to lower levels of economic growth. The Federal Reserve uses various tools, such as setting interest rates and adjusting reserve requirements for banks, to manage the money supply and maintain stable economic conditions.

Impact of Money Supply Contraction

The Federal Reserve monitors the money supply closely and can take actions to adjust the money supply as needed to promote stable economic conditions. A contraction in the money supply can have several impacts on the economy. One potential consequence is a decrease in economic activity, as businesses and consumers have less money to spend. This can lead to lower levels of employment, reduced economic growth, and potentially even a recession.

Why is Money Supply contracting now?

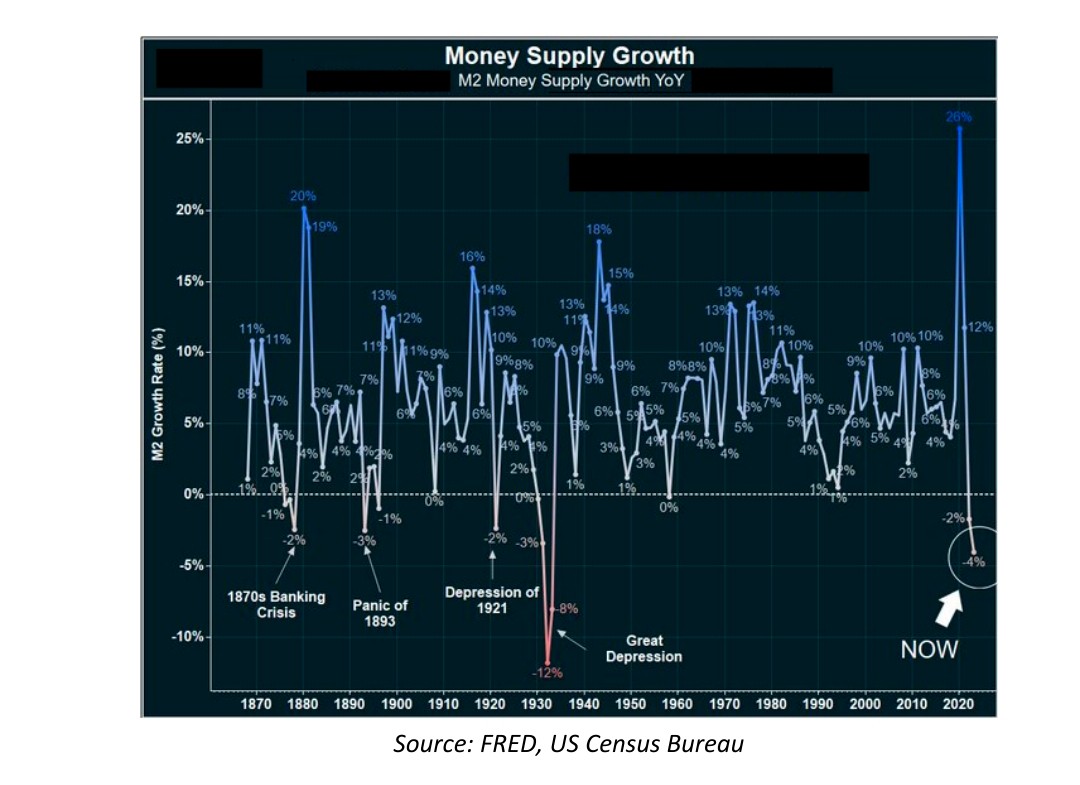

A warning sign for the economy and financial markets is the fact that the U.S. money supply is declining at its fastest rate since the 1930s, as shown in the chart above. US Money Supply (M2) growth has turned into a negative zone on a YoY basis with a level of -4% in March 2023. This is largely a result of the Federal Reserve’s quantitative easing programme, declining bank deposits, weak credit demand and supply, and the reversal of the liquidity created by the massive post-pandemic fiscal and monetary stimulus.

Why is it a concern and impact on Gold and Silver?

This is a massive economic warning as the last money supply contraction happened 93 years back, during the Great Depression of 1929. Previous to that, it happened during the Depression of 1921, the Panic of 1893 and the banking Crisis of 1870, as shown in the chart above. Whenever it happened, we had a Depression/Major Banking Crisis.

All prior situations had unemployment rates that were higher than 10%, significant bank failures, significant layoffs, and significant shutdowns. It is a signal that the Fed doesn’t need to increase interest rates further, all things being equal. The fact that there is a one- to two-year lag between changes in the money supply and their effects on asset prices and inflation may even indicate that the U.S. central bank should be lowering rates.

All this points out that we are going to witness a bullish environment for safe-haven assets Gold and Silver in the coming months. Moreover, there are also other Two themes pushing Gold and Silver: De-dollarization & Recession, which can lead Gold and Silver prices to rise 20% in FY 2023-24.

For a recession-proof portfolio, one should allocate at least 20% portfolio to Gold and Silver. And the best way to stay invested in Gold and Silver in a new financial year is to invest 50% in lumpsum at current prices and divide the rest 50% through the Systematic Investment Plan (SIP) every month. Augmont- Gold for All offers both of these investment alternatives through its products like Digi Gold/Digi Silver and Gold SIP/ Silver SIP.

1 Comment. Leave new

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.