By Renisha Chainani, Head Of Research, Augmont Gold For All

As inflationary pressures continue to weigh heavy on the capital markets, they’re giving bullish gold investors an opportunitytalize on the precious metal’s upside. In addition to inflation, geopolitical tensions in Ukraine are also fuelling a flight to safe-haven assets. Gold exchange-traded funds are one of this year’s hottest investments, with war, inflation and stock-market volatility sending people scrambling for safe-havens.

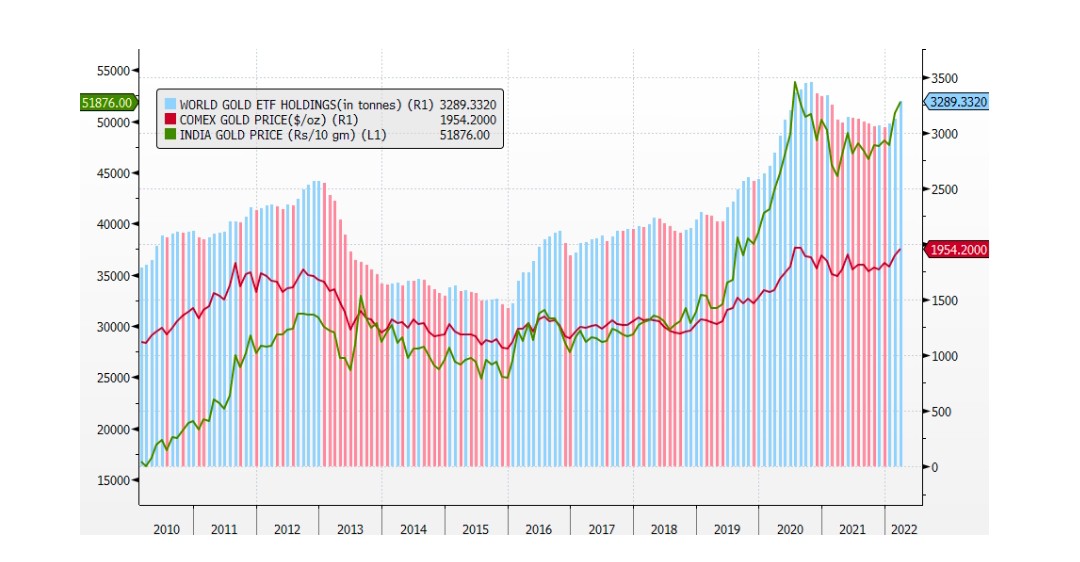

Gold price and World Gold ETF Holdings

The most consequential line of thought for gold is the multi-directional tug of war between Fed policy’s impact on rates, inflation, potential hits to economic growth, and Russia’s invasion of Ukraine as well as the current and potential further related economic sanctions as the crisis continues.

The two largest gold ETFs by far — State Street’s Gold Shares ETF and the iShares Gold Trust, with assets under management of nearly $100 billion between them — both invest in physical gold bullion and have attracted the majority of the inflows this year.

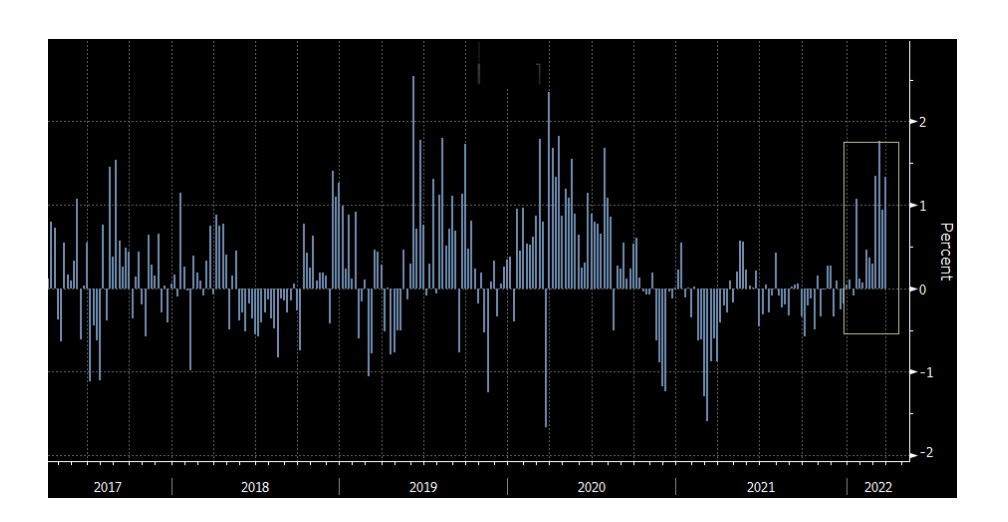

Weekly Gold ETF inflows rising in 2022

As expected, the U.S. Federal Reserve raised the federal funds rate by 25 basis points. Even as more rate hikes are expected throughout the course of 2022, I don’t believe it will affect gold’s potential upside. Even the idea of a rising interest rate environment nipping at the heels of the gold market is not enough to offset the positive pressures that we’re seeing from the inflationary tilt.

I believe that the Fed remains behind the curve. The Russia-Ukraine war and its widespread

market implications continue on the front burner for gold. Gold is in the sweet spot as higher inflation is good for precious metals and also any beginning of economic recession also helps gold in gaining ground. Historically, whenever the US Fed lays out plans for their rate hikes, gold prices make bottom and start to rally. So, all factors point to higher gold prices.

You may also like to read: Market Drivers for Gold in 2022

1 Comment. Leave new

iiZu