Silver fell to its lowest level since December by falling more than 6.5% this week, as indicators of a strong economy fuelled expectations that policymakers would soon begin to remove stimulus. Gold has plunged to its lowest level in over a month. Retail sales in the United States unexpectedly increased in August, as increased purchases across most categories more than offset decline at auto dealerships, demonstrating persistent consumer demand for goods. Treasury yields and the currency rose more, lowering demand for precious metals, which do not pay interest.

Investor interest in both metals is essentially non-existent. When yields fall, they do nothing, but when they rise, they plummet. That’s a really unhealthy reaction function, and it’s left them vulnerable, as evidenced by today’s high retail sales, which fueled fears of an expedited taper. Last year’s surge in gold and silver was aided by substantial central bank support. While the Federal Reserve was likely to start winding down its bond-buying programmed sooner than expected, precious metals have been weighed down in the last few months.

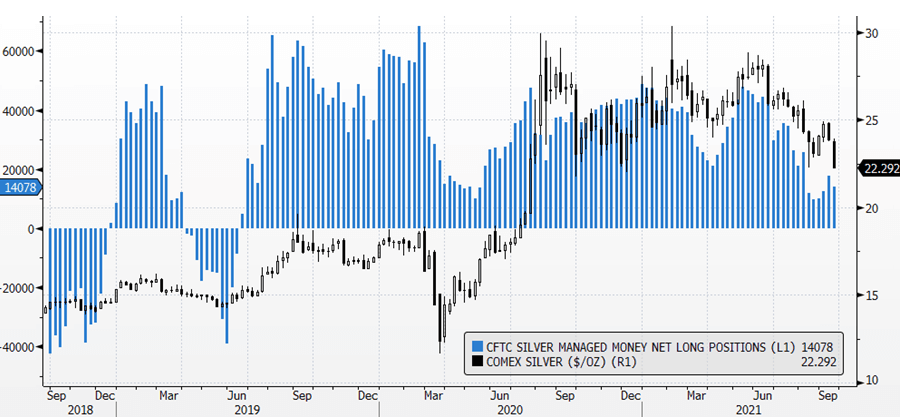

Traders will be looking for further signals on a schedule for decreasing bond purchases at the Federal Reserve’s two-day policy meeting beginning Sept. 21. The $24 level represents substantial resistance, as it has previously been critical. Moreover, Money managers have decreased their bullish silver bets by 3,834 net-long positions to 14,078 contracts last week, weekly CFTC data on futures and options show.

COMEX Silver and CFTC Positions Weekly Chart

As seen in the above chart, there is a good correlation among CFTC positions and silver prices. In addition, while soldering contact conductor material, silver is commonly employed. As a result, silver prices will rise as soon as the global semiconductor business recovers to normal output levels and eliminates the supply shortfall, owing to stable demand in this field. Furthermore, as the global economy improves, raw material demand will stabilize and expand. This is likewise true with silver.

India Spot Silver Weekly Chart

Domestically, Silver has been trading in a downtrend channel from the last 5 months. A move above resistance of 64000 will validate the up move. Next support is around 58000, which is also the 38.2% retracement of the move from 36000 to 74000.