By Dr. Renisha Chainani, Head- Research, Augmont – Gold for all

The debt ceiling is the maximum amount of money the US can borrow overall through the issuance of bonds. The debt ceiling was established during World War I to control government spending and keep the government fiscally responsible. The debt ceiling, also known as the debt limit or statutory debt limit, was established by the Second Liberty Bond Act of 1917. In 1939, Congress set the first aggregate debt ceiling, which essentially applied to all government debt. It was set at $45 billion, or roughly 10% of the total debt at the time.

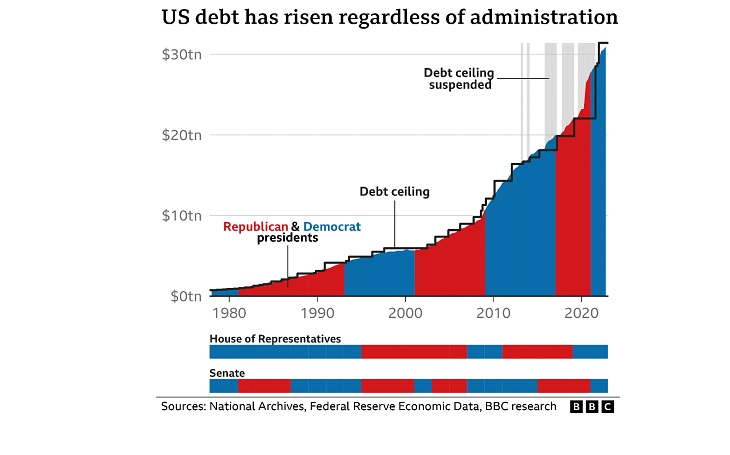

In order to prevent the worst-case scenario—the US government going into default on its debt—the debt ceiling has been raised or suspended numerous times over the years. Since 1960, the debt ceiling has been raised, extended, or revised 78 times, according to the United States Department of Treasury.

As of June 1, 2023, the current debt ceiling is $31.4 trillion. President Biden raised it to this level in 2021. To deal with the US debt ceiling default, both political parties – Democrats led by President Joe Biden and Republicans led by Kevin McCarthy – have proposed various spending cuts.

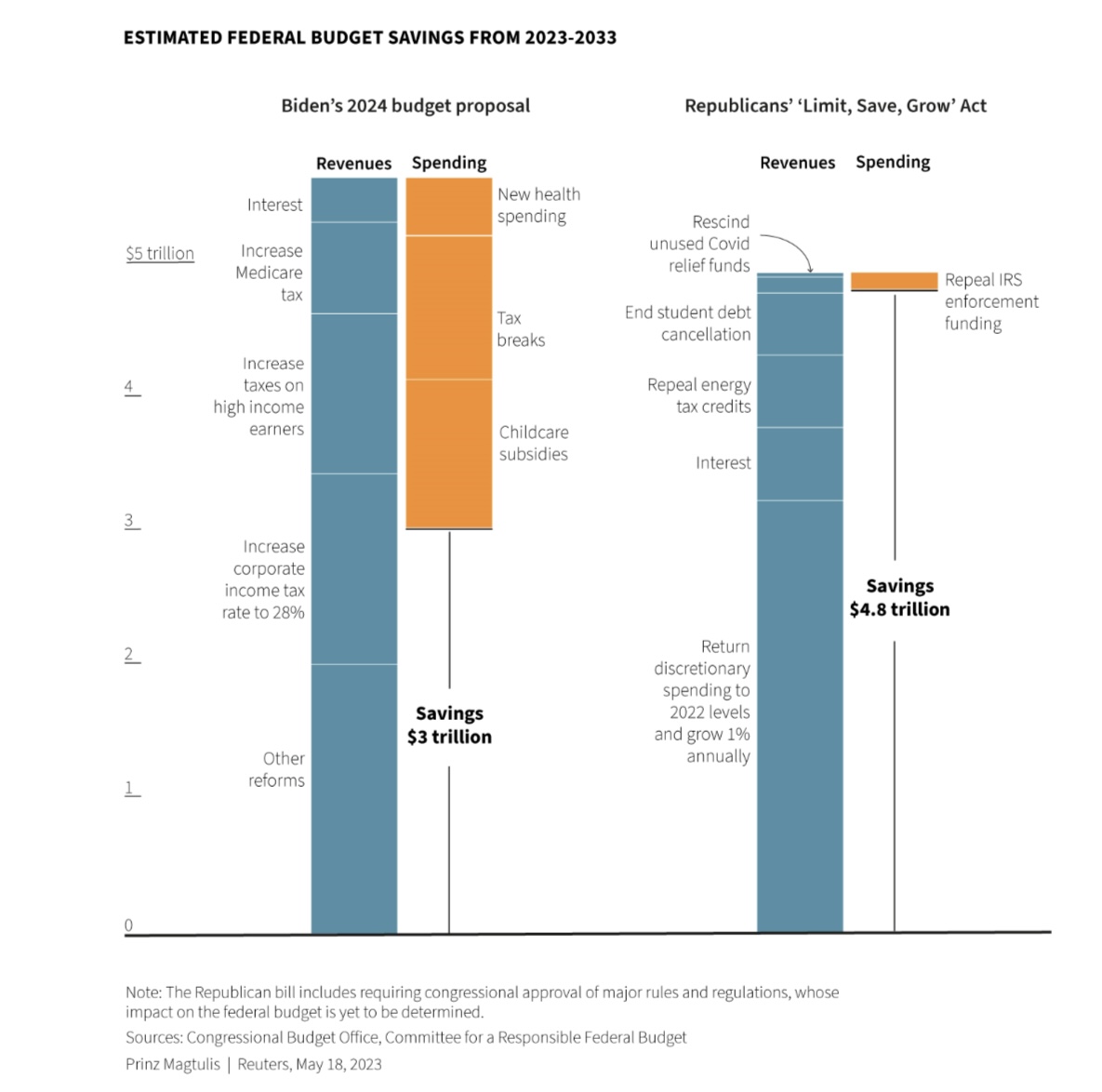

Republicans: Full implementation of the Limit, Save, and Grow Act would result in a $4.804 trillion reduction in the 10-year deficit from the CBO’s February baseline.

Democrats: The White House estimates that fully implementing the fiscal 2024 budget request would result in a $2.857 trillion reduction in deficits.

Discussions have been ongoing for a few days, but both political parties must agree on common ground and pass a bill before June 1st to avoid the US government defaulting. Because a government debt default would have a profound impact on the world’s financial markets and cause US borrowers’ confidence to decline.

Gold and silver prices are consistently supported by market negotiations and risk-on sentiment. As the threat of an economic nightmare compelled US President Joe Biden to call a conclusion to the G7 meeting last weekend, he and top congressional Republican Kevin McCarthy moved closer to an agreement to avert a looming US debt default.

Gold and Silver prices have retraced from the last two weeks, as it was in an overbought zone. But this is a healthy correction in the long-term bullish market. If a deal is reached this weak, before the 1st June deadline, we can see more profit-booking in Gold and Silver prices this week. But if there is no deal by the end of this week, Gold and Silver could get safe-heaven bids and recover to its highs again. These dips should be used as buying opportunities as Gold and Silver prices are expected to rise 20% from current levels in FY 2023-24 to $2400 (Rs 70000) for gold and $30 (Rs 90000) for silver.

For a recession-proof portfolio, one should allocate at least 20% portfolio to Gold and Silver. And the best way to stay invested in Gold and Silver in a new financial year is to invest 50% in lumpsum at current prices and divide the rest 50% through the Systematic Investment Plan (SIP) every month. Augmont- Gold for All offers both of these investment alternatives through its products like Augmont Digi Gold/Digi Silver and Augmont Gold SIP/ Silver SIP.

Disclaimer: This report contains the opinion of the author, which is not to be construed as investment advices. The author, Directors, other employees of Augmont Enterprise Private Ltd. and its affiliates cannot be held responsible for the accuracy of the information presented herein or for the results of the positions taken based on the opinions expressed above. The above-mentioned opinions are based on the information, which is believed to be accurate, and no assurance can be given for the accuracy of the information. The author, directors and other employees and any affiliates of Augmont Enterprise Private Ltd cannot be held responsible for any losses in trading. In no event should the content of this research report be construed as an express or an implied promise, guarantee or implication by or from Augmont Enterprise Private Ltd. that the reader or client will profit or the losses can or will be limited in any manner whatsoever. Past results are no indications of future performance. Information provided in this report is intended solely for informative purposes and is obtained from sources believed to be reliable. The information contained in this report is no way guaranteed. No guarantee of any kind is implied or possible where projections of future conditions are attempted. We do not offer any sort of portfolio advisory, portfolio management or investment advisory services. The reports are only for information purpose and are not to be construed as investment advices.

1 Comment. Leave new

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.