Gold was trading above $2000 at this point of the time in August 2020. But now it’s struggling to trade above $1800 this year in 2021. Let’s check out what has changed in the last one year, which is keeping Gold away from $2000.

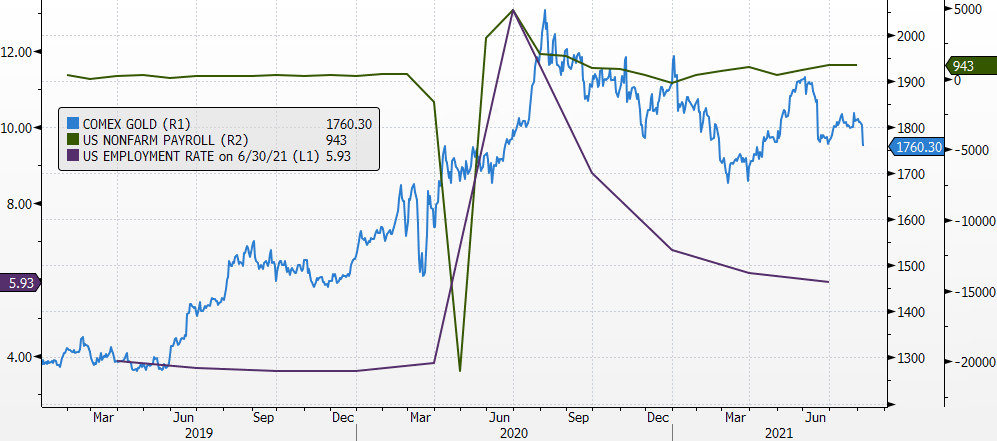

- US Employment Market improving

US Employers have added more jobs in 2021 as seen in Nonfarm Payroll data which is stagnant around 800-900K Jobs added every month. US Unemployment rate which was sharply higher around 12% in 2020 has gradually come down to 6% now. Improvement in Employment Market is a bearish sign for Gold.

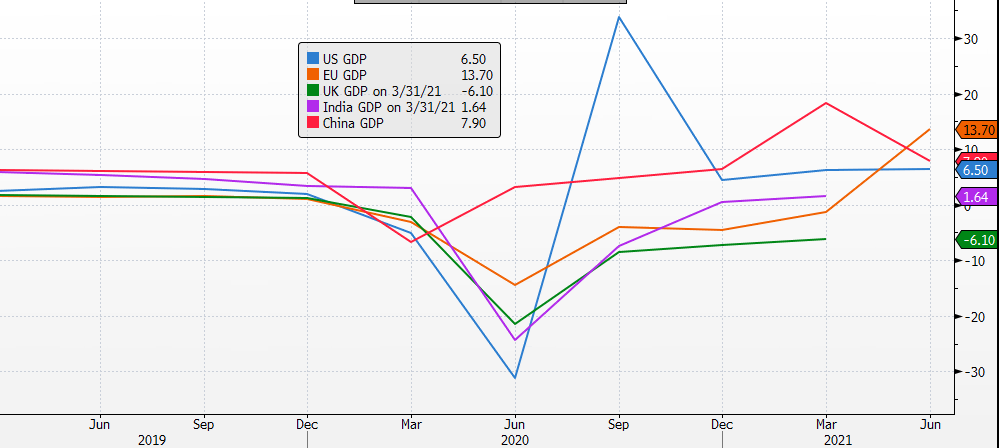

- Economic Growth recovering

After witnessing a recession in the second quarter of 2020, there is a V-shaped recovery seen in the GDP of developed and emerging economies. In 2021, all countries have witnessed growth (although slower), but the situation is far better than negative growth last year. This factor creates a headwind for gold prices to rise.

- Gold ETF Holdings abating

Gold Investment demand through ETFs was very strong in 2020 as Gold was considered as a safe-haven in times of uncertainty in the pandemic. But in 2021, worldwide Gold ETF holdings have been continuously coming down. Almost 300 tonnes of outflows have been witnessed in 2021. Till time, we don’t see good investment demand through ETFs, Gold prices might trade lacklustre.

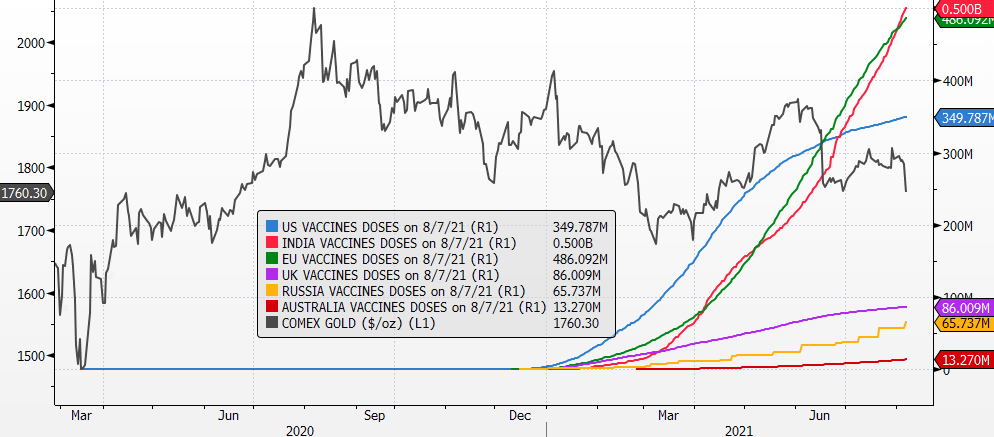

- Significant rise in COVID-19 Vaccination

All the countries around the world have worked very hard to get their population vaccination against COVID-19 in the first seven months of 2021. Almost 30% of the world population have received at least one dose of the COVID-19 vaccine, while 15% are fully vaccinated. Therefore, active COVID cases have gradually come down and there is less fear and uncertainty in the market, which plays as RISK-OFF sentiment for Gold prices.

Outlook for 2H 2021

The ultra-low interest-rate environment that investors have experienced for a prolonged period is creating structural changes in asset allocation. Interest rates will likely remain a key driver for gold in the short and medium term.

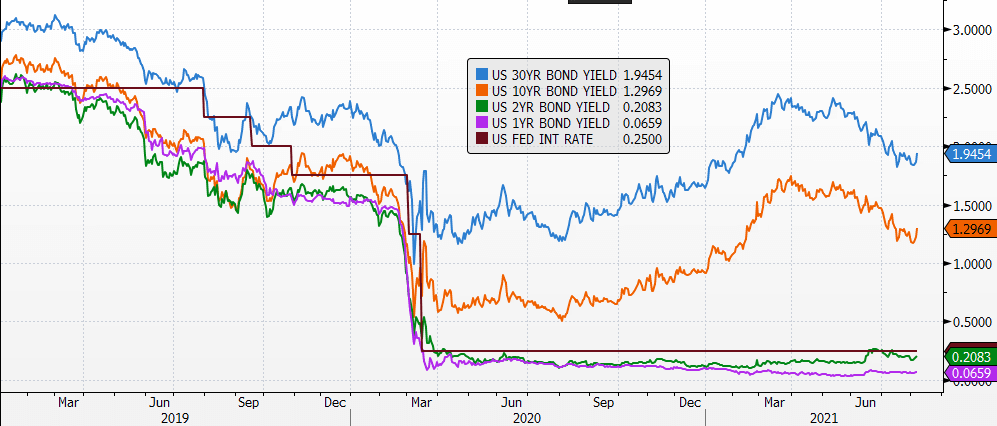

- Falling Bond Yields in the US and record low-interest rate

After falling to record low levels in March 2020, US Treasury Bond Yields were on the rise next one whole year. But with the start of the financial year 2021-22, longer-term bond yields have started falling again. US 1 year bond yield has been trading at record low levels again now. Time and again, FED members have hinted that monetary easing would continue for comings months and tapering is not in their hindsight as of now. This factor could prove a tailwind for gold prices in the coming days ahead.

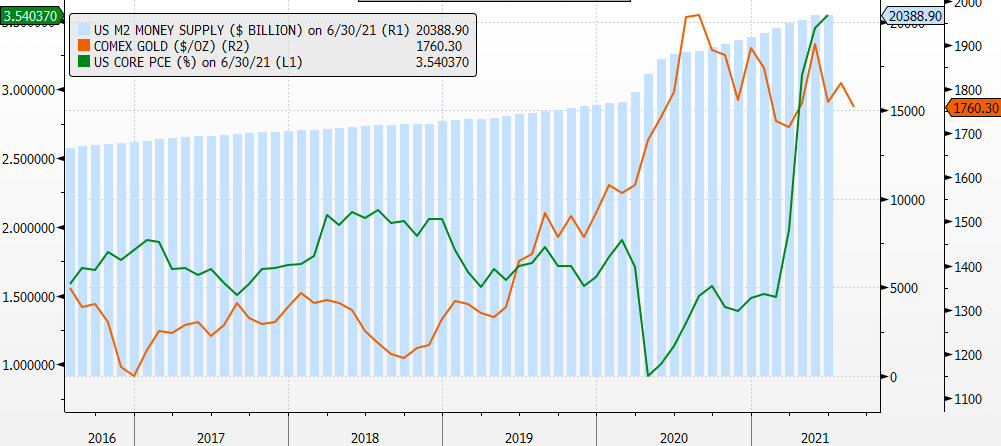

- US Soaring Inflation and Money supply

Gold is closely correlated with broader inflation indicators such as money supply, which continues to grow, potentially leading to inflation bubbles, currency debasement, and global market instability. This may lead global investors to seek gold as a means of hedging against capital depreciation. However, while inflation has been rising, there is disagreement over whether the rise in consumer prices will be transitory or long-term. If price inflation persists, gold has historically performed well. Gold, for example, had an annual average return of 15% in years when the US CPI was more than 3%.

When combined with favourable entry levels, these variables may entice strategic investors to add gold to their allocation plans, therefore supporting central bank demand in the second half of the year. While the economic recovery and current price drop may help customers, new COVID variations may restrict acceptance in gold jewellery in key markets.

Moreover, central banks such as the ECB and FED have recommended softer inflation targets, with the FED most recently concentrating on employment as a signal of whether to modify their policy. Seasonal patterns are frequently used by investors to identify optimal entry and exit points. According to our research, gold has historically delivered positive returns in September, with a confidence level just shy of 90%. As a result, investors have frequently chosen August as a good opportunity to add gold to their portfolios.